导入相关函数库

import pandas as pd

import numpy as np

from pandas import Series, DataFrame

import matplotlib.pyplot as plt

%matplotlib inline

from datetime import datetime

import seaborn as sns

sns.set()

从cvs读取文件

ba = open('BABA.csv')

am = open('AMZN.csv')

alibaba = pd.read_csv(ba, index_col=0)

amazon = pd.read_csv(am, index_col=0)

alibaba.head()

Open High Low Close Adj Close Volume

Date

2015-09-21 65.379997 66.400002 62.959999 63.900002 63.900002 22355100

2015-09-22 62.939999 63.270000 61.580002 61.900002 61.900002 14897900

2015-09-23 61.959999 62.299999 59.680000 60.000000 60.000000 22684600

2015-09-24 59.419998 60.340000 58.209999 59.919998 59.919998 20645700

2015-09-25 60.630001 60.840000 58.919998 59.240002 59.240002 17009100

画图

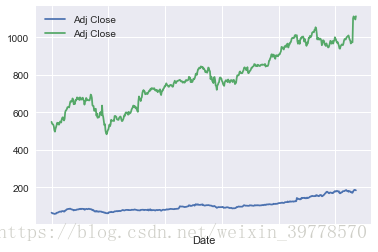

alibaba['Adj Close'].plot(legend=True)

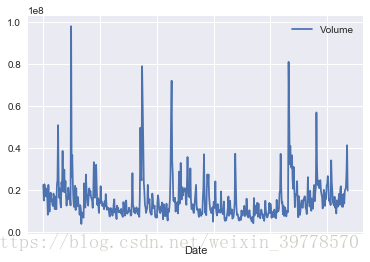

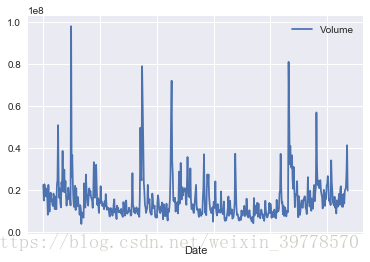

alibaba['Volume'].plot(legend=True)

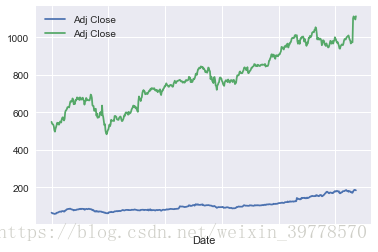

alibaba['Adj Close'].plot(legend=True)

amazon['Adj Close'].plot(legend=True)

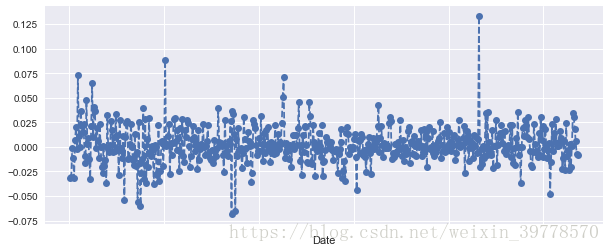

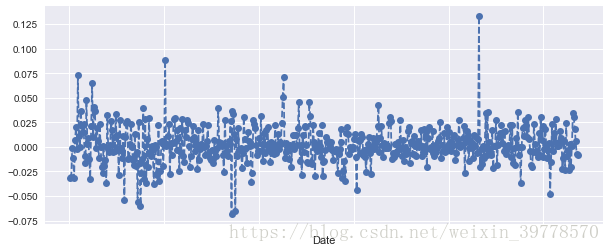

pct_change

alibaba['daily-return'] = alibaba['Adj Close'].pct_change()

alibaba['daily-return'].plot(figsize=(10,4), linestyle='--', marker='o')

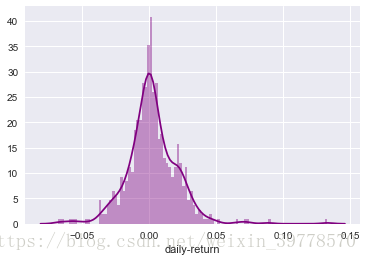

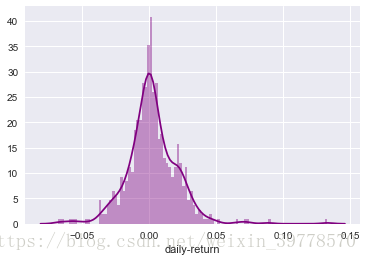

直方图和密度图

sns.distplot(alibaba['daily-return'].dropna(), bins=100, color='purple')

多只股票的关盘价分析

f = open('top5.csv')

top_tech_df = pd.read_csv(f, index_col=0)

top_tech_df = top_tech_df.sort_index()

top_tech_df.head()

AAPL AMZN FB GOOG MSFT

Date

2014-12-31 104.863991 310.350006 78.019997 523.521423 43.266247

2015-01-02 103.866470 308.519989 78.449997 521.937744 43.555000

2015-01-05 100.940392 302.190002 77.190002 511.057617 43.154472

2015-01-06 100.949890 295.290009 76.150002 499.212799 42.521076

2015-01-07 102.365440 298.420013 76.150002 498.357513 43.061325

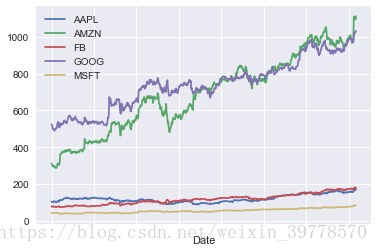

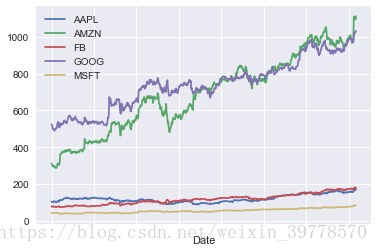

关盘价盈亏比

top_tech_dr = top_tech_df.pct_change()

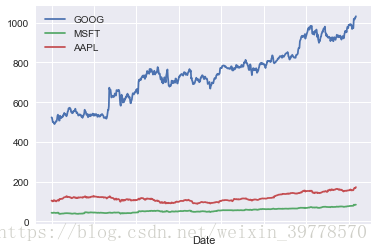

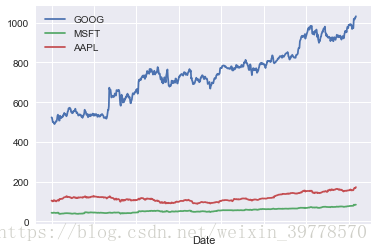

画图

top_tech_df.plot()

top_tech_df[['GOOG','MSFT','AAPL']].plot()

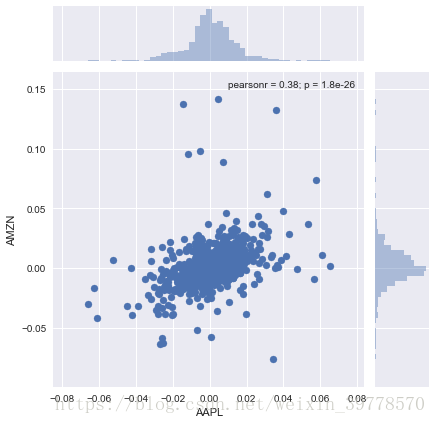

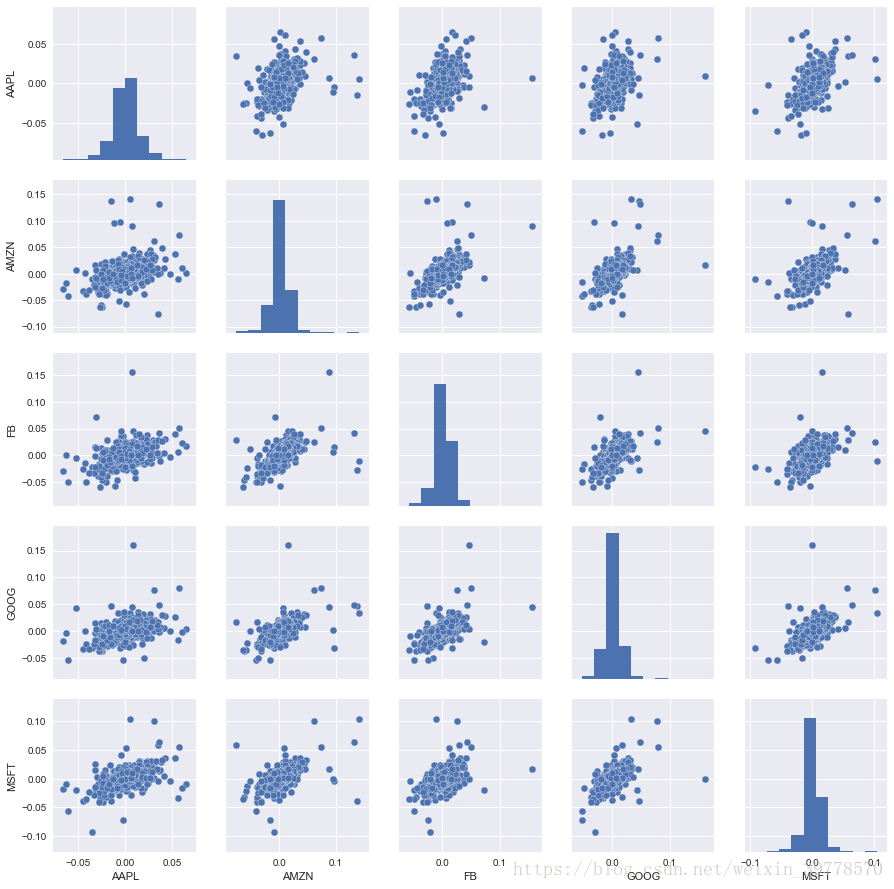

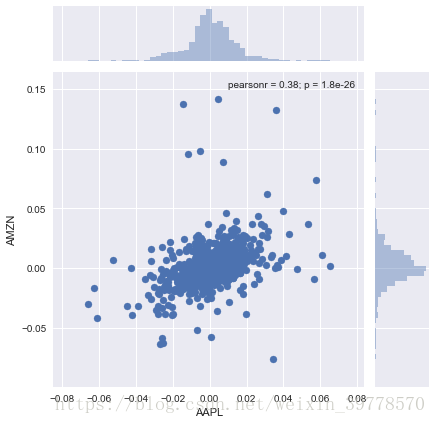

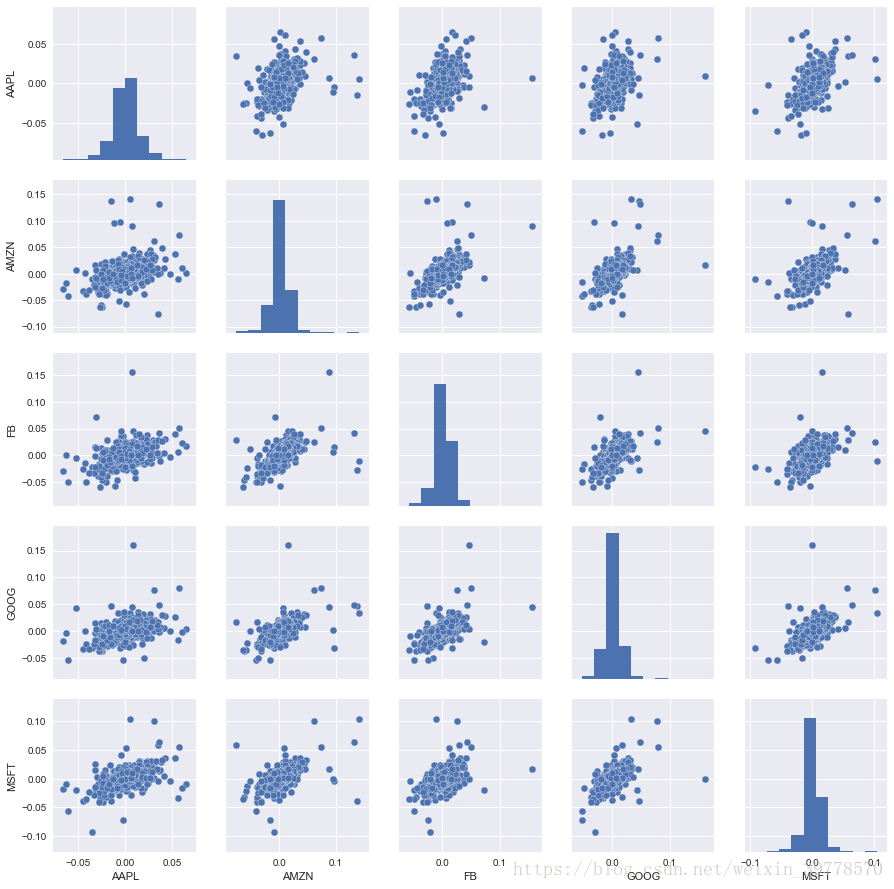

相关性分析

sns.jointplot('AAPL','AMZN',top_tech_dr, kind='scatter')

sns.pairplot(top_tech_dr.dropna())

风险分析

top_tech_dr['AAPL'].quantile(0.52)

0.001107631364068098

top_tech_dr['GOOG'].quantile(0.1)

-0.013821200284433788

top_tech_dr['AMZN'].quantile(0.1)

-0.014841820375433912