代码如下:

#!/usr/bin/python

# -*- coding: utf-8 -*-

"""

@file: calculate.py

@author: xiaoxiao

@date: 2018-07-07 17:30:32

"""

class Calculate(object):

def __init__(self, base_limit, tax_base, tax_3, tax_10, tax_20, tax_25, tax_30, tax_35):

self.base_limit = base_limit

self.tax_base = tax_base

self.tax_3 = tax_3

self.tax_10 = tax_10

self.tax_20 = tax_20

self.tax_25 = tax_25

self.tax_30 = tax_30

self.tax_35 = tax_35

# ********** 公积金 ********** #

# 计算公积金个人缴纳:12%

def calculate_personal_accumulation_fund(self, n):

if n < self.base_limit:

return n * 0.12

else:

return self.base_limit * 0.12

# 计算公积金单位缴纳:12%

def calculate_unit_accumulation_fund(self, n):

if n < self.base_limit:

return n * 0.12

else:

return self.base_limit * 0.12

# ********** 养老保险 ********** #

# 计算养老保险个人缴纳:8%

def calculate_personal_endowment_insurance(self, n):

if n < self.base_limit:

return n * 0.08

else:

return self.base_limit * 0.08

# 计算养老保险单位缴纳:19%

def calculate_unit_endowment_insurance(self, n):

if n < self.base_limit:

return n * 0.19

else:

return self.base_limit * 0.19

# ********** 失业保险 ********** #

# 计算失业保险个人缴纳:0.2%

def calculate_personal_unemployment_insurance(self, n):

if n < self.base_limit:

return n * 0.002

else:

return self.base_limit * 0.002

# 计算失业保险单位缴纳:0.8%

def calculate_unit_unemployment_insurance(self, n):

if n < self.base_limit:

return n * 0.008

else:

return self.base_limit * 0.008

# ********** 工伤保险 ********** #

# 计算工伤保险单位缴纳:0.4%(个人不缴)

def calculate_unit_injury_insurance(self, n):

if n < self.base_limit:

return n * 0.004

else:

return self.base_limit * 0.004

# ********** 生育保险 ********** #

# 计算生育保险单位缴纳:0.8%(个人不缴)

def calculate_unit_maternity_insurance(self, n):

if n < self.base_limit:

return n * 0.008

else:

return self.base_limit * 0.008

# ********** 医疗保险 ********** #

# 计算医疗保险个人缴纳:2%

def calculate_personal_medical_insurance(self, n):

if n < self.base_limit:

return n * 0.02

else:

return self.base_limit * 0.02

# 计算医疗保险单位缴纳:10%

def calculate_unit_medical_insurance(self, n):

if n < self.base_limit:

return n * 0.10

else:

return self.base_limit * 0.10

# ********** 个人所得税 ********** #

def calculate_personal_income_tax(self, m):

m = m - self.tax_base

if m <= 0:

return 0

elif m < self.tax_3:

return m * 0.03

elif m < self.tax_10:

return m * 0.10 - self.tax_3 * 0.07

elif m < self.tax_20:

return m * 0.20 - self.tax_10 * 0.1 - self.tax_3 * 0.07

elif m < self.tax_25:

return m * 0.25 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07

elif m < self.tax_30:

return m * 0.30 - self.tax_25 * 0.05 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07

elif m < self.tax_35:

return m * 0.35 - self.tax_30 * 0.05 - self.tax_25 * 0.05 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07

else:

return m * 0.45 - self.tax_35 * 0.1 - self.tax_30 * 0.05 - self.tax_25 * 0.05 - self.tax_20 * 0.05 - self.tax_10 * 0.1 - self.tax_3 * 0.07

n = int(input('请输入工资数:'))

# 其它补贴

allowance = int(input('其它补贴:'))

calculation = Calculate(25401, 3500, 1500, 4500, 9000, 35000, 55000, 80000)

calculation_new = Calculate(25401, 5000, 3000, 12000, 25000, 35000, 55000, 80000)

# ***** 公积金 ****** #

calculate_personal_accumulation_fund = calculation.calculate_personal_accumulation_fund(n)

calculate_unit_accumulation_fund = calculation.calculate_unit_accumulation_fund(n)

# print '缴纳的公积金为:' + str(calculate_personal_accumulation_fund + calculate_unit_accumulation_fund)

# ***** 养老保险 ***** #

calculate_personal_endowment_insurance = calculation.calculate_personal_endowment_insurance(n)

calculate_unit_endowment_insurance = calculation.calculate_unit_endowment_insurance(n)

# ***** 失业保险 ***** #

calculate_personal_unemployment_insurance = calculation.calculate_personal_unemployment_insurance(n)

calculate_unit_unemployment_insurance = calculation.calculate_unit_unemployment_insurance(n)

# ***** 工伤保险 ***** #

calculate_unit_injury_insurance = calculation.calculate_unit_injury_insurance(n)

# ***** 生育保险 ***** #

calculate_unit_maternity_insurance = calculation.calculate_unit_maternity_insurance(n)

# ***** 医疗保险 ***** #

calculate_personal_medical_insurance = calculation.calculate_personal_medical_insurance(n)

calculate_unit_medical_insurance = calculation.calculate_unit_medical_insurance(n)

print('\n公积金:【个人:%.2f】【单位:%.2f】' % (calculate_personal_accumulation_fund, calculate_unit_accumulation_fund))

print('养老保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_endowment_insurance, calculate_unit_endowment_insurance))

print('失业保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_unemployment_insurance, calculate_unit_unemployment_insurance))

print('工伤保险:【个人:0】【单位:%.2f】' % calculate_unit_injury_insurance)

print('生育保险:【个人:0】【单位:%.2f】' % calculate_unit_maternity_insurance)

print('医疗保险:【个人:%.2f】【单位:%.2f】' % (calculate_personal_medical_insurance, calculate_unit_medical_insurance))

personal_all = calculate_personal_accumulation_fund + calculate_personal_endowment_insurance + calculate_personal_unemployment_insurance + calculate_personal_medical_insurance

unit_all = calculate_unit_accumulation_fund + calculate_unit_endowment_insurance + calculate_unit_endowment_insurance + calculate_unit_injury_insurance + calculate_unit_maternity_insurance + calculate_unit_medical_insurance

print('总共缴纳:【个人:%.2f】【单位:%.2f】\n' % (personal_all, unit_all))

# ***** 税前应发工资 ***** #

total_pay_amount = n - personal_all + allowance

print("1.老版纳税税级距:3500[base]-1500[3%]-4500[10%]-9000[20%]-35000[25%]-55000[30%]-80000[35%]-above[45%]")

print("2.新版纳税税级距:5000[base]-3000[3%]-12000[10%]-25000[20%]-35000[25%]-55000[30%]-80000[35%]-above[45%]")

# ***** 缴纳的个人所得税 ***** #

personal_tax_old = calculation.calculate_personal_income_tax(total_pay_amount)

personal_tax_new = calculation_new.calculate_personal_income_tax(total_pay_amount)

print('\n应发工资:【%.2f】\n' % total_pay_amount)

print('老版个人所得税:【%.2f】' % personal_tax_old)

final_paying_amount_old = total_pay_amount - personal_tax_old

print('老版实发工资:【%.2f】\n' % final_paying_amount_old)

print('新版个人所得税:【%.2f】' % personal_tax_new)

final_paying_amount_new = total_pay_amount - personal_tax_new

print('新版实发工资:【%.2f】' % final_paying_amount_new)

print('\n新版比老版少缴纳个人所得税:【%.2f】' % (personal_tax_old - personal_tax_new))

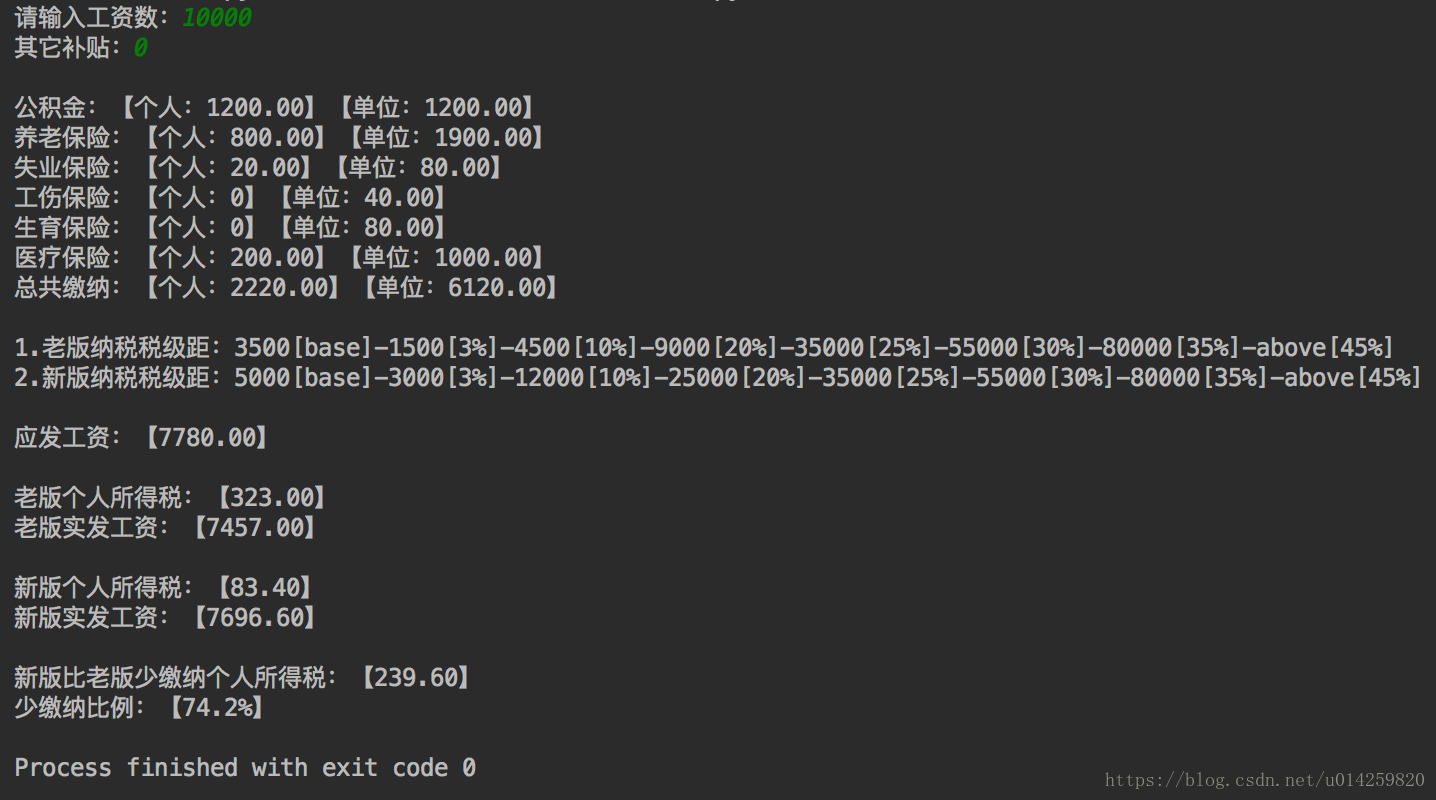

print('少缴纳比例:【%.1f%%】' % ((personal_tax_old - personal_tax_new) / personal_tax_old * 100))计算结果:

由此可见,在不计算其它补贴的情况下,纯月薪10000,以前到手7457.00元,现在到手7696.60元。缴纳的个税,相比之前的323.00元,现在只需缴纳83.40元,可以少交税239.60元,少缴纳了74.2%。