原文链接:http://tecdat.cn/?p=12187

金融分析师通常关心检测市场何时“发生变化”:几个月或至几年内市场的典型行为可以立即转变为非常不同的行为。投资者希望及时发现这些变化,以便可以相应地调整其策略,但是这样做可能很困难。

RHmm从CRAN不再可用,因此我想使用其他软件包复制功能实现马尔科夫机制转换(Markov regime switching)模型从而对典型的市场行为进行预测,并且增加模型中对参数的线性约束功能。

library(SIT)

load.packages('quantmod')

# find regimes

load.packages('RHmm', repos ='http://R-Forge.R-project.org')

y=returns

ResFit = HMMFit(y, nStates=2)

VitPath = viterbi(ResFit, y)DimObs = 1

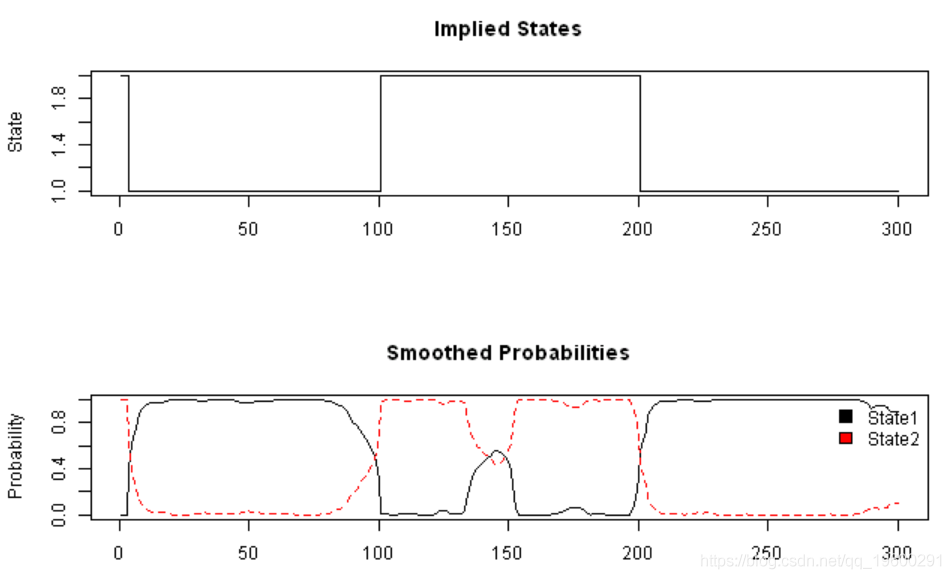

matplot(fb$Gamma, type='l', main='Smoothed Probabilities', ylab='Probability')

legend(x='topright', c('State1','State2'), fill=1:2, bty='n')

fm2 = fit(mod, verbose = FALSE)使用logLik在迭代69处收敛:125.6168

probs = posterior(fm2)

layout(1:2)

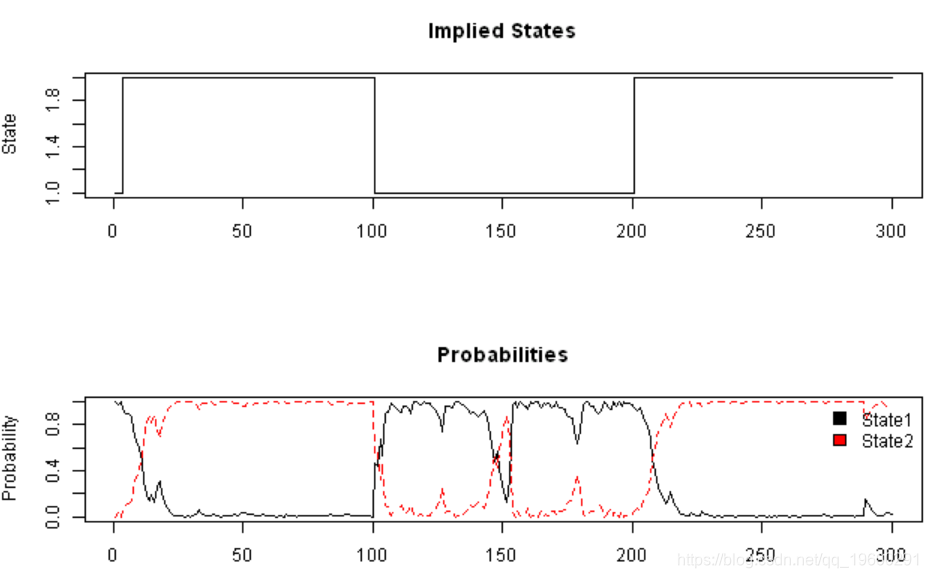

plot(probs$state, type='s', main='Implied States', xlab='', ylab='State')

matplot(probs[,-1], type='l', main='Probabilities', ylab='Probability')

legend(x='topright', c('State1','State2'), fill=1:2, bty='n')

#*****************************************************************

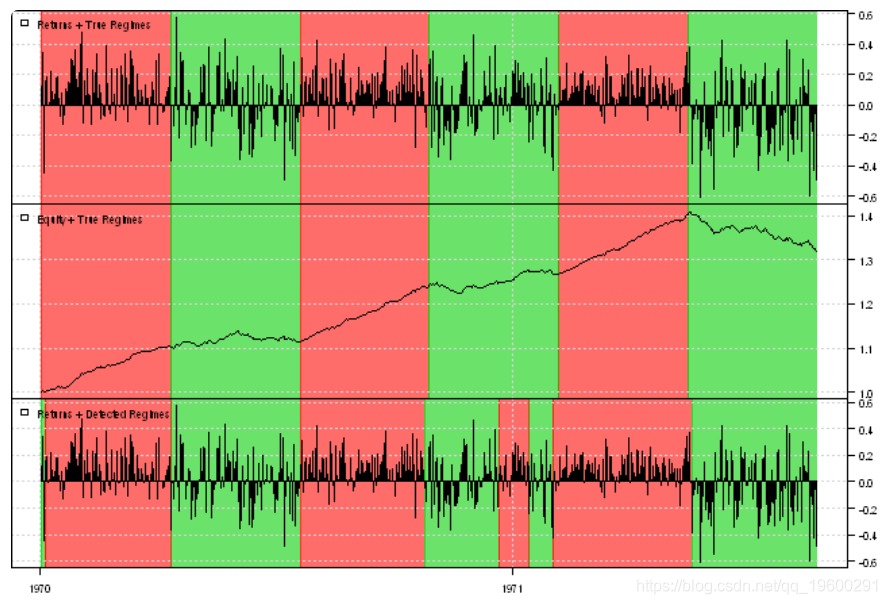

# Add some data and see if the model is able to identify the regimes

#******************************************************************

bear2 = rnorm( 100, -0.01, 0.20 )

bull3 = rnorm( 100, 0.10, 0.10 )

bear3 = rnorm( 100, -0.01, 0.25 )

true.states = c(true.states, rep(2,100),rep(1,100),rep(2,100))

y = c( bull1, bear, bull2, bear2, bull3, bear3 )

DimObs = 1

plota(data, type='h', x.highlight=T)

plota.legend('Returns + Detected Regimes')

#*****************************************************************

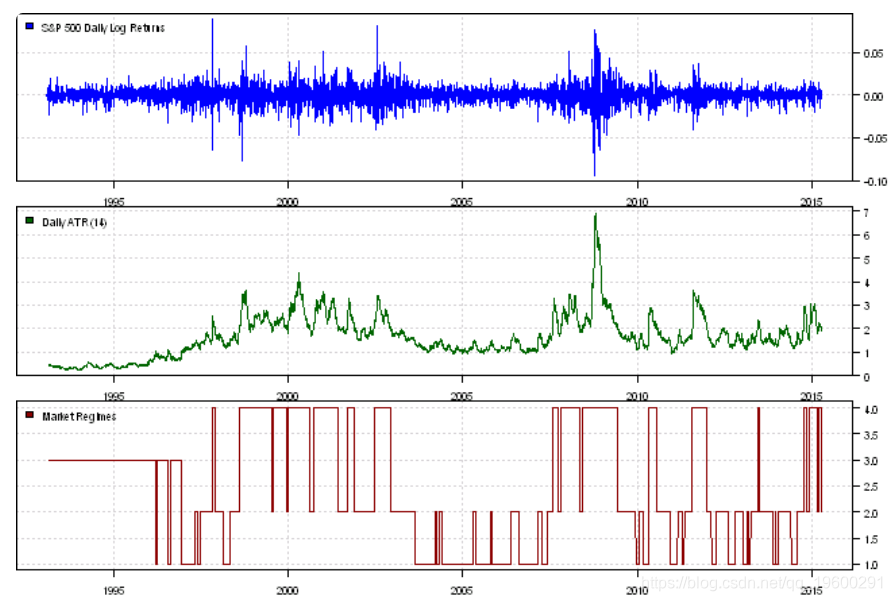

# Load historical prices

#******************************************************************

data = env()

getSymbols('SPY', src = 'yahoo', from = '1970-01-01', env = data, auto.assign = T)

price = Cl(data$SPY)

open = Op(data$SPY)

ret = diff(log(price))

ret = log(price) - log(open)

atr = ATR(HLC(data$SPY))[,'atr']

fm2 = fit(mod, verbose = FALSE)使用logLik在迭代30处收敛:18358.98

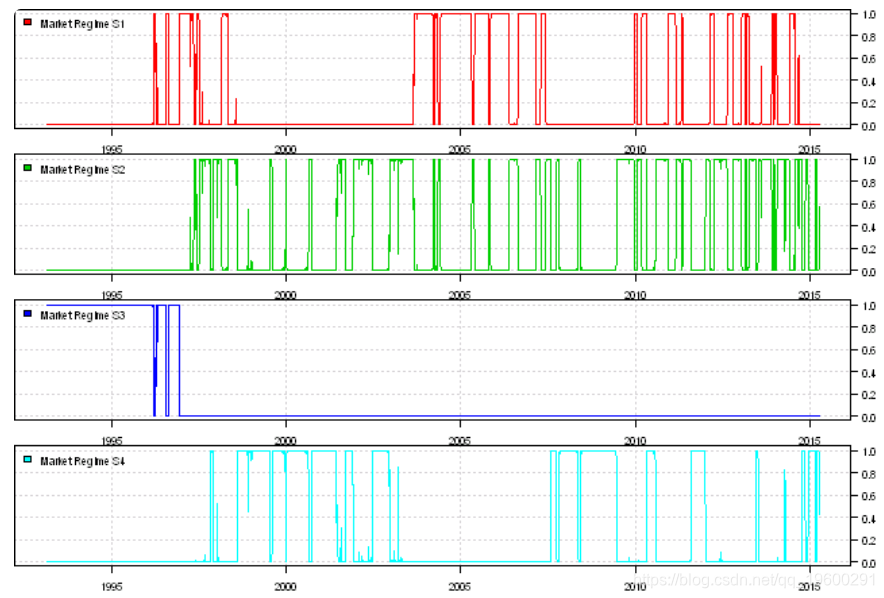

probs = posterior(fm2)

print(head(probs))layout(1:3)

plota(temp, type='l', col='darkred')

plota.legend('Market Regimes', 'darkred')

layout(1:4)