The Chicago Board Options Exchange (CBOE) is about to launch Ethereum futures!

According to Business Insider, CBOE may launch Ethereum futures at the end of 2018.

When it comes to futures in the virtual currency field, most practitioners may remember the scenes when Bitcoin futures were released at the end of 2017. The more impressive one are the super bullish market that were indirectly triggered by that.

As the world’s second largest virtual currency, Ethereum has been controversial recently in terms of the Ethereum Problem of congestion. Foreign well-known blockchain authors believe that ETH value will return to zero in the future, and the news of the upcoming Ethereum futures can make Ethereum break away from the whirlpool of public dispute. Will it further have a huge impact on the market?

The industry has great expectations for this.

1.The real needs of Ethereum futures

On August 30, Business Insider reported that the Chicago Board Options Exchange (CBOE) may launch Ethereum futures by the end of 2018.

At the beginning of August this year, the head of the CBOE business development department has stated: “We plan is to launch Ethereum futures trading during the year.”

If the Ethereum futures had successfully pass the approval, it will be the second time for the exchange to launch crypto futures subsequent to Bitcoin futures at the end of 2017.

As early as May of this year, another powerful Chicago Mercantile Exchange (CME) director McCourt has indicated that they were discussing whether it is necessary to launch Ethereum futures trading and their group will test the Ethereum field next to see if there is enough market demand to launch Ethereum futures products.”

Besides, CBOE and CME are both the world’s first exchanges to launch bitcoin futures which had triggered the huge bullish market indirectly at the end of 2017.

The two exchanges have expressed such strong interest in Ethereum futures at the same time, seemly implying that Ethereum futures has great potential to come out soon.

So, is it realistic for CBOE and CME, the world’s top two exchanges, to compete for the launch of Ethereum futures?

“I think this new investment opportunity can save the cryptocurrency market from the downturn, and turn the bear market to a bull market,” said Danny Kim, who manages a cryptocurrency trading technology company.

Danny King’s point of view has a certain representation in the entire market.

As the world’s second-largest cryptocurrency, Ethereum price has risen from $300 in September last year to $1,300. Since then, it has been falling all the way. In just one year, Ethereum has been through an imposing rise and fall.

In this context, there is a huge throwing pressure in Ethereum, and the market is in urgent need of favorable stimulus. So it is logical for the community to take Ethereum futures as a positive, and look forward to the impact of similar bitcoin futures. With the super bull market caused by Bitcoin futures, this is very simple to understand the high market expectation of Ethereum futures the market expectation of Ethereum futures.

In fact, after the Business Insider released the news that “CBOE will launch Ethereum futures at the end of the year” on August 30, the price of Ethereumrose slightly.

After the Ethereum futures information came out, the ETH price rose instantly

The market sideways reaction responded whether it is necessary to launch ethereum futures.

“A large number of projects raised funds through Ethereum, but the price (ETH) was not high, and their days were really tough.” Wang Lei said.

Both the exchange and the project side have great expectations for the pass of Ethereum futures.

However, the first thing that has to be passed through Ethereum futures is the review by US regulators. As a financial tool for the American public and institutional investors, this is a step that must be taken.

On June 15 this year, William Hinman, an official with the Securities and Exchange Commission (SEC) responsible for developing cryptocurrency policies, said at the industry summit held at Yahoo: “Bitcoin and Ethereum are not securities.”

“Bitcoin futures, in fact, had already passed before the SEC stated bitcoin and Ethereum attributes.” said Shangguan, who has long been engaged in policy research in the financial sector and started a business in the blockchain field.

From this perspective, Ethereum futures seem to have more protection than Bitcoin currency futures.

Therefore, Ethereum futures have met various requirements of policy, market and technology. It seems that Ethereum futures seems to be upcoming.

But is this really the case?

2. Ethereum’s shorts

Tom Lee, a famous Wall Street analyst who believes that launching Ethereum futures may not be a good thing.

Perhaps some unique views on the market are correct.

“Since December of last year, if an investor is not optimistic about one aspect of cryptocurrency, but does not want to have the underlying assets (ie, the cryptocurrency spot), then they can short the bitcoin. Now, they can also choose to short the Ethereum. This means that the net short position in Bitcoin futures will fall,” Tom Lee said.

So why is it not bitcoin, but Ethereum?

Maybe Tom Lee’s inference is just an unfounded guess, but some data may explain the problem.

According to the bitcoin news from thenextweb, on June 11, 2018, the total circulation of Ethereum officially exceeded the 100 million, which means that more than 100 million Ethereums are currently circulating in the market. This is not like Bitcoin setting its supply cap to 21 million. Ethereum chose not to set a maximum circulation on its total currency issuance.

This has caused the Ethereum community to worry about excessive inflation in the Ethereum, and it has given more reasons to short the Ethereum.

“At present, a large number of Ethereum are being hoarded in the hands of the project parties, and they may crack the market at any time.” Wang Lei said.

This is one of the important features of Ethereum different from Bitcoin. Ethereum does not have a value storage function. In the event of unpredictable risks, Ethereum may face large-scale project-side collapse, and such a scenario seems to have occurred recently.

For example, from May to August, Ethereum experienced a “mass shipment” process, and the price dropped from 800 dollars to 300 dollars. Eth historical price from citicoins.com

Recently, well-known blockchain author Jeremy Rubin made a more pessimistic conclusion to Ethereum. He predicted that the Ethereum network may continue to exist, but the value of the Ethereum ETH will return to zero in the future.

These seem to have added a “drama” to short Ethereum.

The Short may be just one aspect of the threat that Ethereum is facing, and more serious may still be in terms of its value stability.

3. The abortions of Ether’s applications

“Bitcoin has been accepted around the world, but Ethereum is too dependent on its own application,” said Shangguanbi. “When Ethereum loses its value of decommissioning, it may become worthless.”

Of course, Shangguanbi may be considering the problem from a more extreme perspective.

However, the reality is moving in this direction.

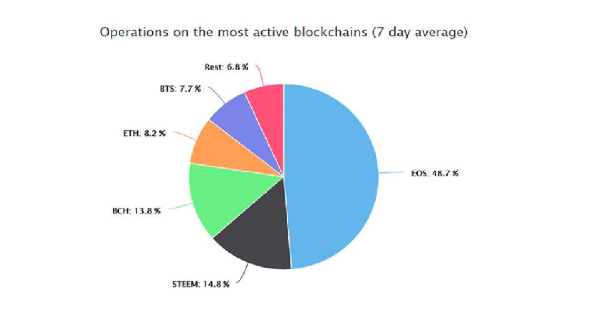

According to the blocktivity.info statistics, in the cryptocurrency items included in the statistics, the proportion of calculations processed by EOS coin in 7 days accounts for 48.7% of all cryptocurrency calculations, which is close to 50%.

At the same time, another survey data also showed that EOS had an average 24-hour trading volume of 4.7 million in the last week of August; according to Blocktivity data, EOS’s trading volume peaked more than 100 million times.

Dapp performance is heavily dependent on the operating frequency of the main network, and EOS clearly has an absolute advantage in this regard. This illustrates a problem from the side, ETH may be facing the dilemma of losing its application advantages.

So, for Ethereum, why is the application based on this network so important?

“In extreme cases, if no one use Ethereum, it may return to zero in an instant.” Shangguanbi said, “And now some of the previous Ethereum development teams are already turning their attention to EOS.”

In mid-August of this year, HPT was launched on Huobi, as the pass card in Huobi mining pool, playing an important role in the fire currency ecology. However, this pass card is based on the EOS public chain.

“If you put it a year ago, you wouldn’t even think about launching project through other public chain project aparting from Ethereum.” As a hardcore fan of Vitalik, Wang Lei is a bit worried about the current situation of Ethereum. “Now the entire industry is doing blockchain. There are so many engineers developed by Dapp, turning to EOS and other public chains, and there will be fewer and fewer developers on Ethereum.”

The number of active Ethereum applications has even been surpassed by Kin, the blockchain public chain project that has recently erupted.

The reduction in application, for Ethereum, may mean taking a drastic measure to deal with the situation, which will naturally have a huge negative effect on prices.

Under the trend of reduced use of Ethereum-supported applications, how to maintain the stability of Ethereum’s value is a problem that needs attention. The greater the stability, the lower the risk, and the lower risk is also an important consideration for the US SEC to adopt a financial instrument.

Therefore, from the perspective of stability, the Ethereum futures door seems to be blocked.

Does this mean the beginning of Ethereum’s winter?

4. Vitalik hardly conceal his anxiety

At the Ethereum Technology and Applications Conference held in June 2018, V God gave a keynote speech titled “The Latest Developments in Casper and Fragmentation Technology”.

As a recipe for “rescue” the performance of Ethereum, is fragmentation technology really invincible?

“Fragmentation Technology can improve the current congestion problem in Ethereum, but it will take a lot of time to apply,” Shangguanbi said when it comes to fragmentation technology. “It may be a year or two, maybe longer. Developers are certainly more willing to try on other public chains.”

“Maybe Ethereum is really falling behind.” Wang Lei said.

In August 2018, V God said in an interview that he is fully studying the proof of rights.

Ethereum has four milestones; these four stages are Frontier, Homestead, Metropolis, and Serenity. The so-called proof of equity is the pos consensus mechanism, which means that Ethereum is ready to transit to the fourth phase of development.

The Ethereum is still in a quiet period, which means that the public chain is still in the POW consensus stage, and it is impossible to fundamentally solve the efficiency problem of the Ethereum public chain. The POW consensus also means that Ethereum will face the dilemma of continuous over-exposure.

“Of course, super-issue is not the crux of the problem. The inefficiency of Ethereum is the problem that V God has to solve.” Wang Lei said.

In the face of EOS, ælf, stellar and other public chain projects, can ETH break through the encirclement and create the next public chain miracle? For the Ethereum, where the ship is difficult to turn around, this is about the survival of the entire community.