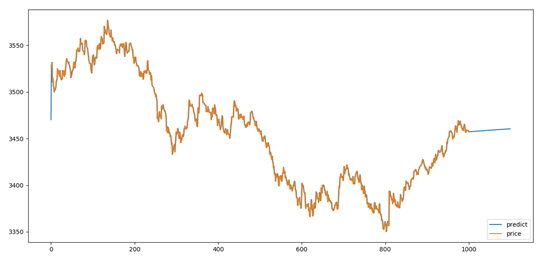

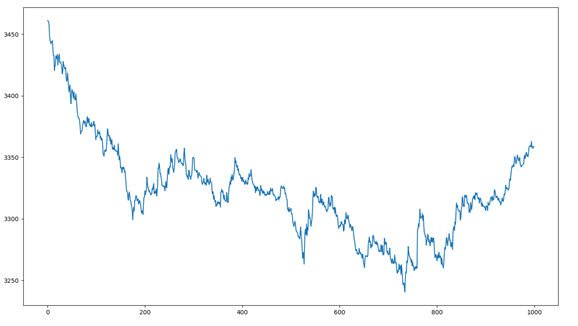

CFFEX.IF1808,截止到当日的1000条收盘价格走势:

# encoding: utf-8

import talib

from talib.abstract import SMA

import numpy as np

import pandas as pd

import math

import datetime

from collections import deque

from gm.api import * #掘金

import matplotlib.pyplot as plt

import matplotlib as mpl

import mpl_finance as mpf

import matplotlib.dates as mpd

import seaborn as sns

import statsmodels.tsa.stattools as ts

import statsmodels.api as sm

from statsmodels.tsa.arima_model import ARMA

from scipy import stats

from statsmodels.graphics.api import qqplot

set_token('****************************') #自行填写自己的token

now=datetime.datetime.now().date() last_day=get_previous_trading_date(exchange='SHSE',date=now) index_futures=get_continuous_contracts(csymbol='CFFEX.IF',start_date=last_day,end_date=last_day) #print index_futures strike_info=history_n(symbol='CFFEX.IF1808',frequency='60s',end_time='2018-07-01',fields='symbol,close,frequency,cum_volume',count=1000,df=True) strike_info.dropna() price=np.array(strike_info['close'])

一个时间序列,他可能是有趋势的,是不平稳的,所以如果不平稳需要做差分。

ADF检测结果:

95%置信区间,p=0.0076,99%置信区间下,p=-3.5。对模型做一阶差分,希望得到一个平稳的时间序列

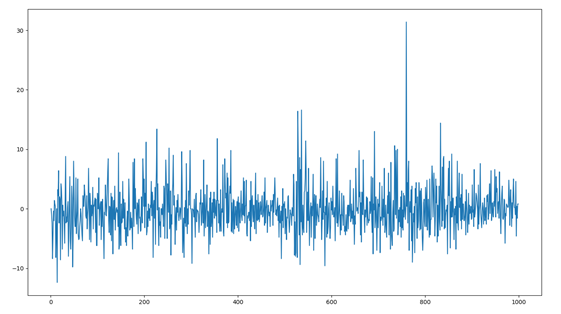

一阶差分后,模型基本平稳:

p=ts.adfuller(strike_info['close'])[0] #print p price_log=strike_info['close'].diff()

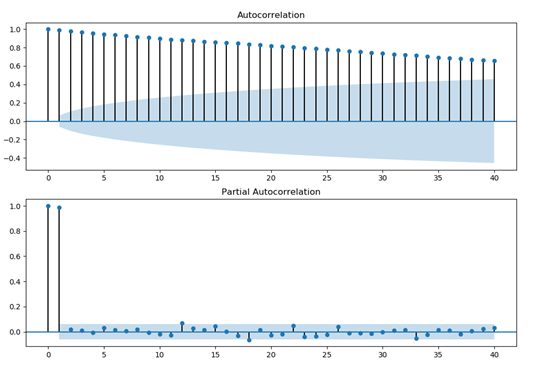

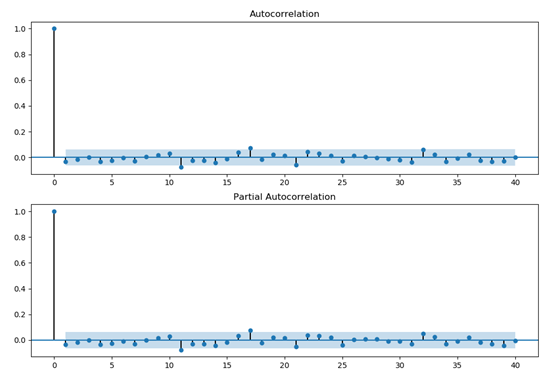

AR(p)模型,PACF会在lag=p时截尾,也就是,PACF图中的值落入宽带区域中。

MA(q)模型,ACF会在lag=q时截尾,同理,ACF图中的值落入宽带区域中。

用ACF(自相关系数)或者PACF(偏自相关系数)观察模型:

fig = plt.figure(figsize=(12,8)) ax1=fig.add_subplot(211) fig = sm.graphics.tsa.plot_acf(strike_info['close'],lags=40,ax=ax1) ax2 = fig.add_subplot(212) fig = sm.graphics.tsa.plot_pacf(strike_info['close'],lags=40,ax=ax2) plt.show()

优先选择PACF图,因为PACF大约在lag=1时截尾,即PACF的值落入宽带区域中

选择AR(P=1)的模型进行自回归拟合,得到拟合效果:

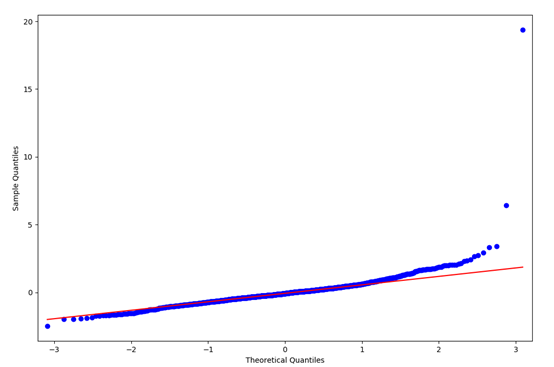

arma_mod80 = sm.tsa.ARMA(strike_info['close'],(1,0)).fit() print(arma_mod80.aic,arma_mod80.bic,arma_mod80.hqic) resid = arma_mod80.resid print(sm.stats.durbin_watson(arma_mod80.resid.values)) print(stats.normaltest(resid)) fig = plt.figure(figsize=(12,8)) ax = fig.add_subplot(111) fig = qqplot(resid, line='q', ax=ax, fit=True) plt.show()

检验:计算得到序列的残差,基本为白噪音

fig = plt.figure(figsize=(12,8)) ax1 = fig.add_subplot(211) fig = sm.graphics.tsa.plot_acf(resid.values.squeeze(), lags=40, ax=ax1) ax2 = fig.add_subplot(212) fig = sm.graphics.tsa.plot_pacf(resid, lags=40, ax=ax2) plt.show()

用自回归拟合的模型进行预测,结果如下:

fig=plt.figure(figsize=(15,7)) price2=strike_info=history_n(symbol='CFFEX.IF1808',frequency='60s',end_time='2018-07-01',fields='symbol,close,frequency,cum_volume',count=1000,df=True)['close'] price3=strike_info=history_n(symbol='CFFEX.IF1808',frequency='60s',end_time=now,fields='symbol,close,frequency,cum_volume',count=1000,df=True)['close'] print len(price2) fit = arma_mod80.predict(0, 1100) plt.plot(range(1100),fit[:1100],label='predict') plt.plot(price2,label='price') plt.legend(loc=4) plt.show()