https://news.cnblogs.com/n/645683/ https://mp.weixin.qq.com/s/_sjx0a0j_gsiUoZE9JI8DQ

October 25 message, the core through the National Intelligence query to enterprise credit information publicity system, National IC Industry Investment Fund II, Ltd. (hereinafter referred to as the "big Fund II") was October 22, 2019 officially registered established with a registered capital of up to 204.15 billion! With the large fund was formally established two investment companies, the development of the domestic semiconductor industry will usher in the strongest thrust.

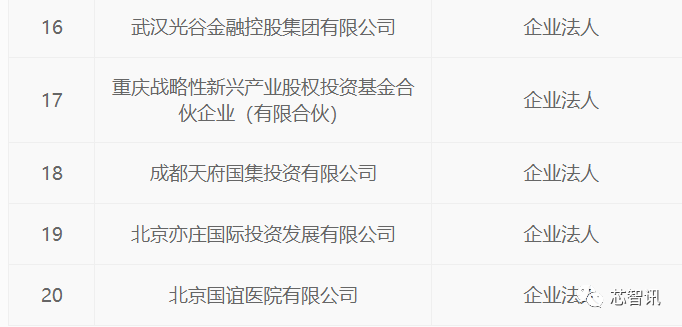

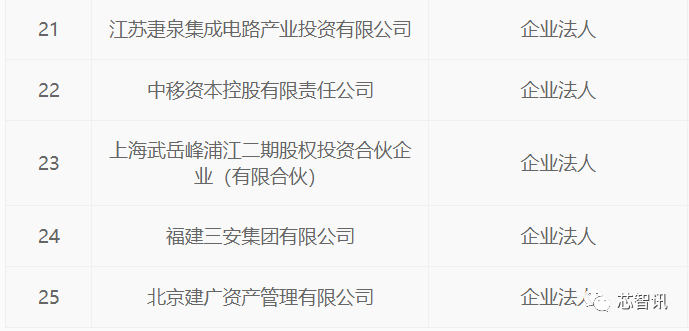

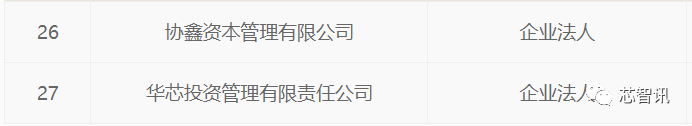

According to the national enterprise credit information publicity system showed two large fund sponsors include the following companies:

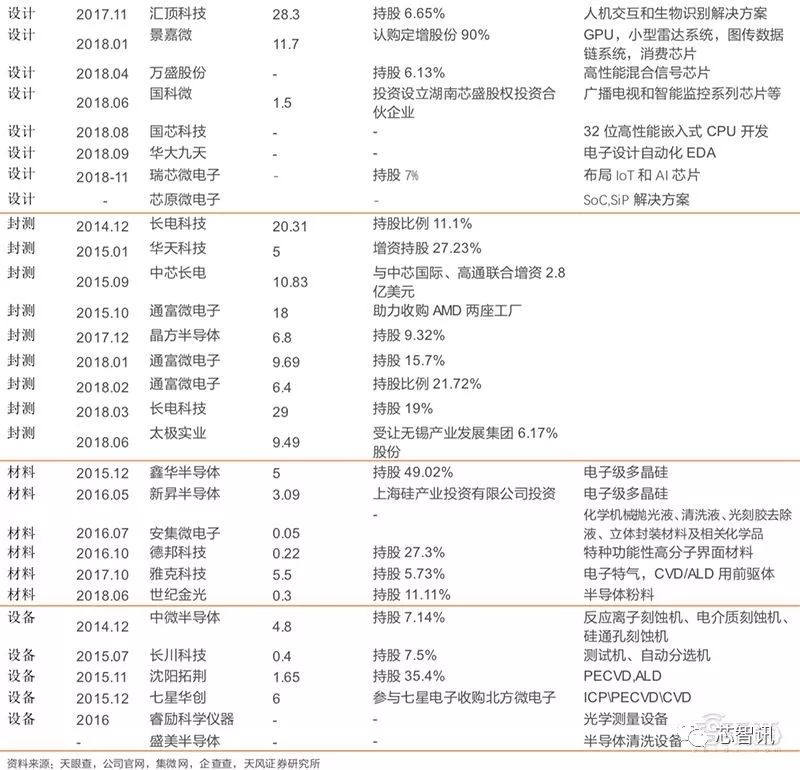

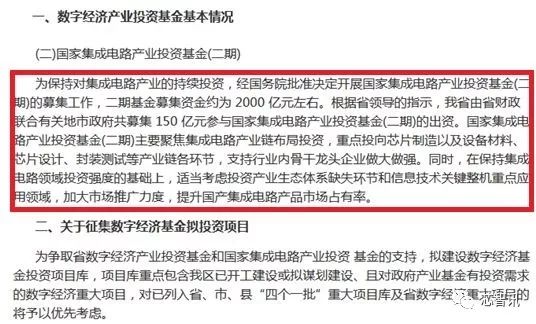

It is understood that in March last year, a large Fund II program has been submitted and approved by the State Council. According to May this year, Hangzhou issued a "Notice of Call for the digital economy in Zhejiang Industrial Investment Fund Project" shows that a large fund two major focus of IC industry chain layout, focus on investment in chip manufacturing equipment and materials, chip design, packaging testing industry chain, to support the industry's leading enterprises bigger and stronger. At the same time, while maintaining the strength of investment in the field of integrated circuits, industrial investment due consideration to the whole ecosystem missing key links and key areas of application of information technology, increase marketing efforts, improve domestic IC market share. From the introduction of view, compared to a large Fund II, the investment coverage will be broader.

Statistics show that a large fund was established in September 24, 2014, a total size of 138.7 billion yuan, focus on investment in the integrated circuit chip manufacturing, both chip design, packaging and testing, equipment, and materials industries. While at the same time a large investment fund, also contributed to the local government and social capital for domestic investment in the semiconductor industry.

Previously, the large fund a core investment manager of China has said that a large investment fund for leveraging social capital investment, to enhance the industry has played an important role in investor confidence. The actual investment fund, the zoom ratio of central government funds accounted for the calculation of 1:19. From the sub-fund, the fund total size of the investment fund of 660 Zhizi 11 billion investment project investment and financing totaling about 170 billion yuan of investment fund zoom ratio close to 1:12. From the fund Xin led the formation of the core lease term, cumulative integrated circuits and semiconductor companies to deliver nearly 400 billion yuan in investment promotion financing also achieved amplification effect 1:11.

Another statistics show that a large fund (including sub-funds) leveraging a total of 514.5 billion yuan of social capital (including equity financing, corporate bonds, banks, trusts and other financial institutions), the proportion of funds leveraging reached 1: 3.7. If a large proportion of leveraging funds 204 150 000 000 Fund II in accordance with the ratio of 1: 4 to estimate, is expected to be 816.6 billion leveraging social funds, the total investment will exceed trillion. Obviously, bring great development which will help domestic IC industry.

Attached to a big fund-invested enterprises (by the Tianfeng Securities incomplete):