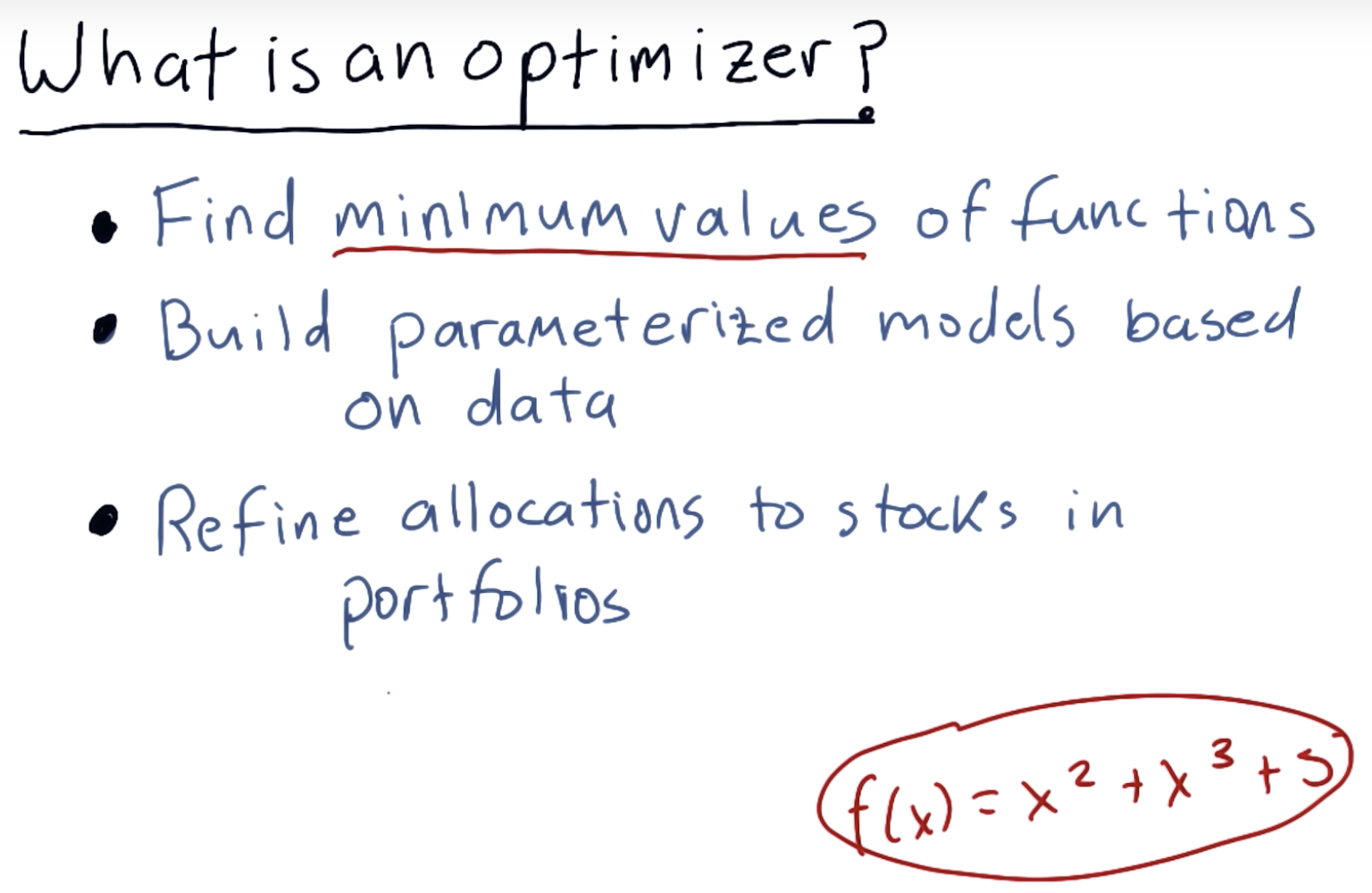

What is an optimizer?

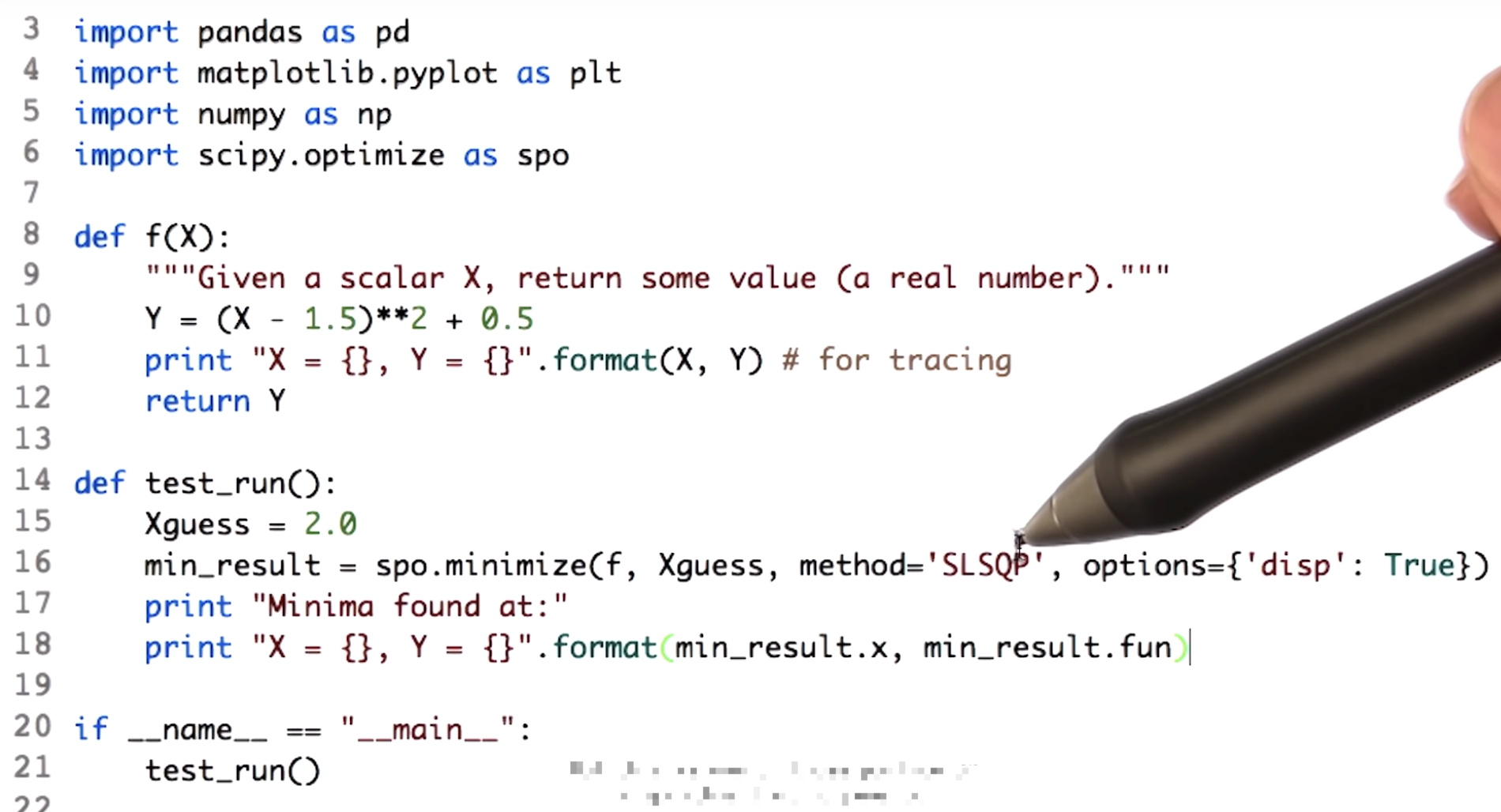

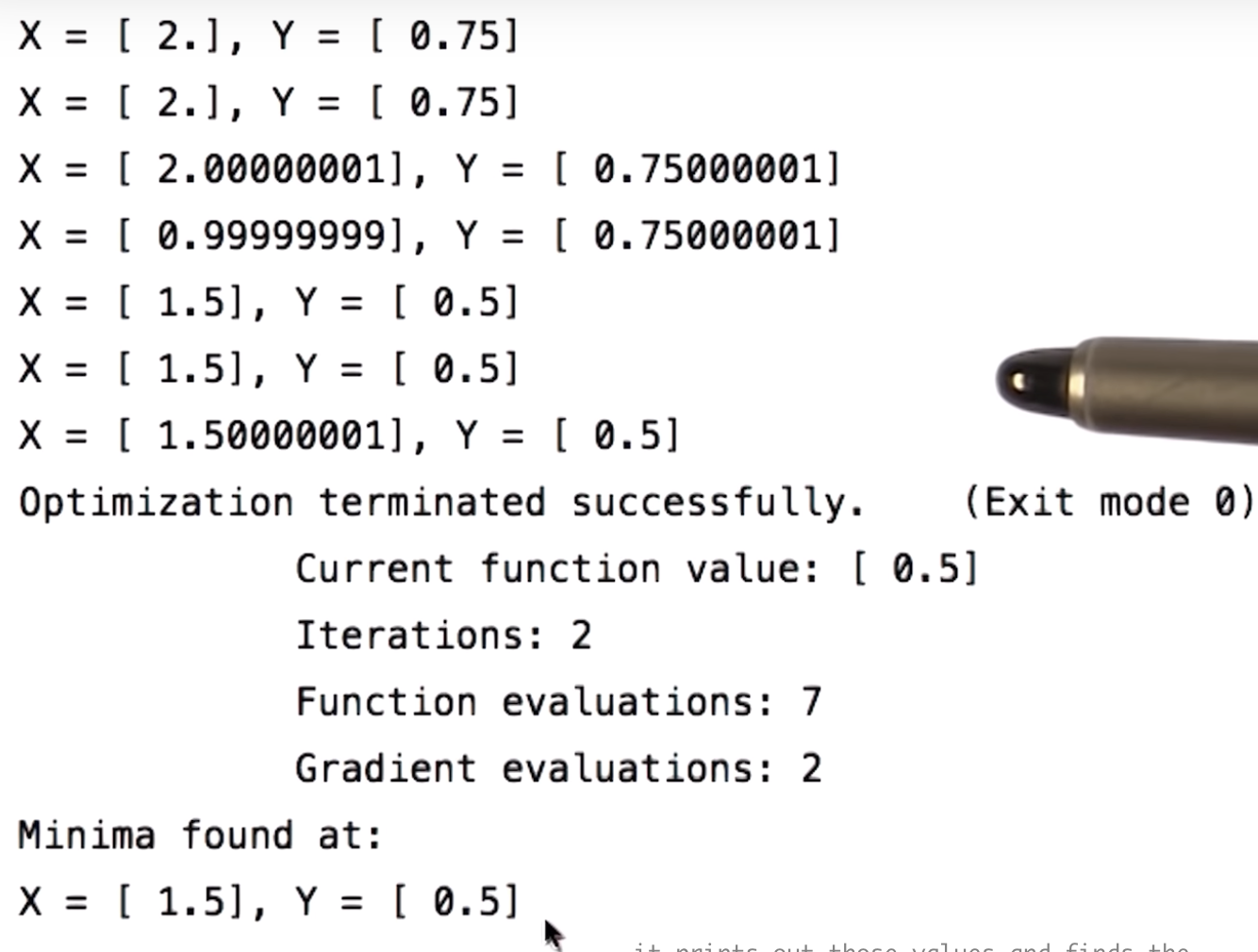

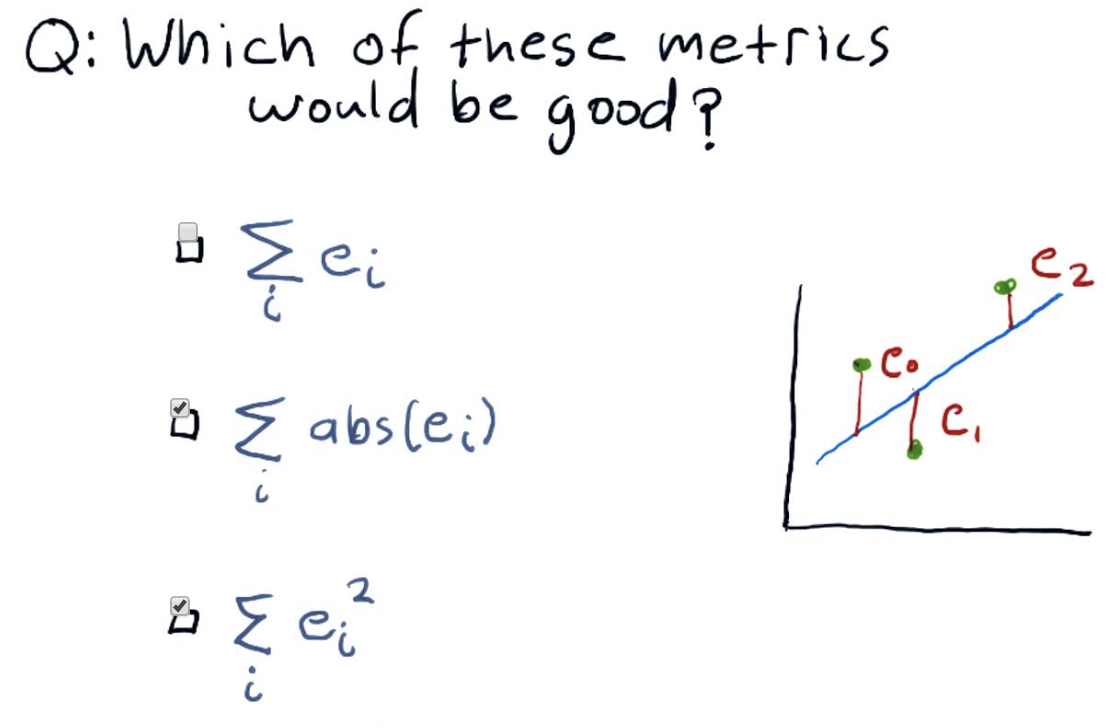

Minimization example

How to defeat a minimizer

Convex problems

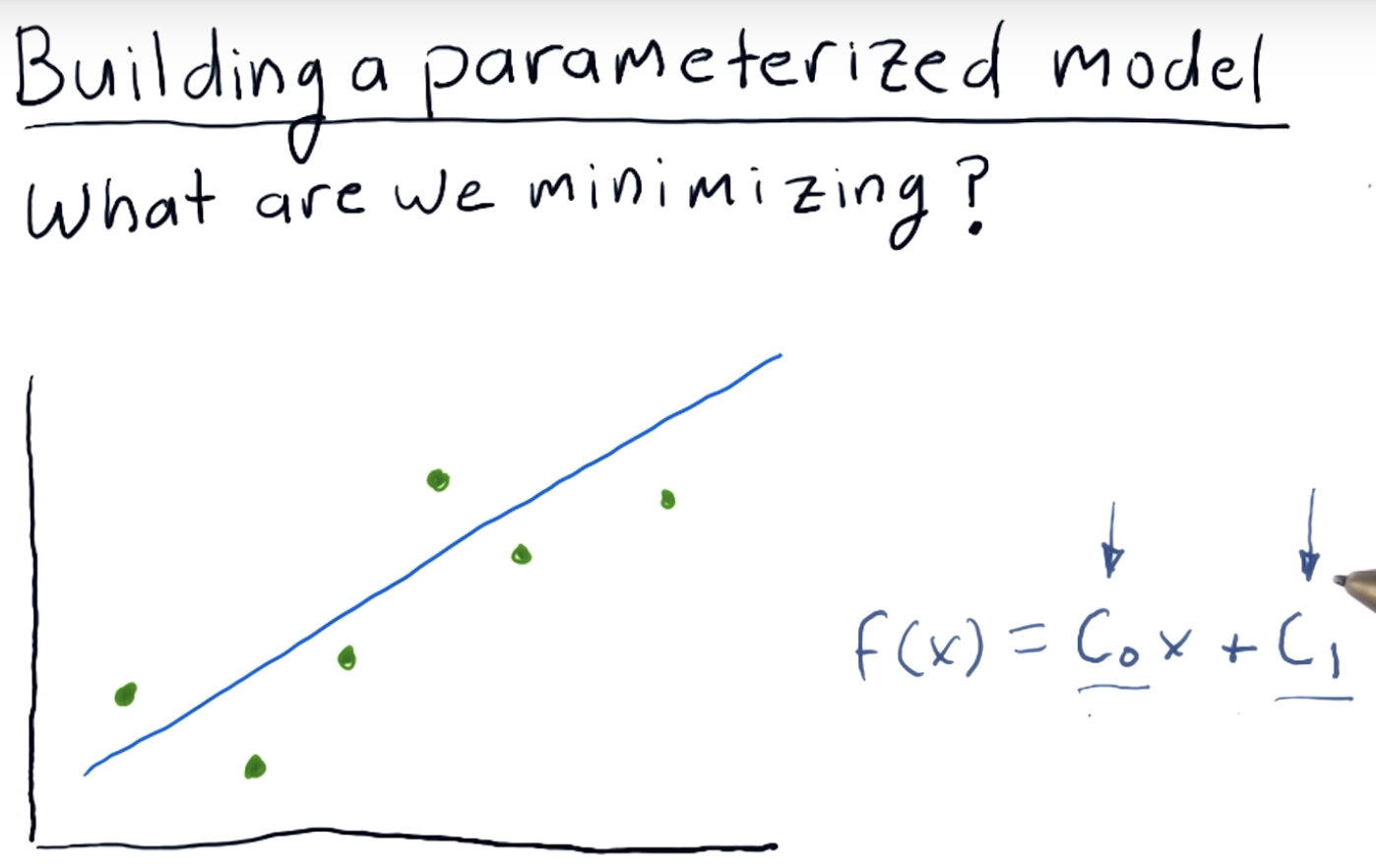

Building a parameterized model

Minimizer finds coefficients

What is portfolio optimization?

The difference optimization can make

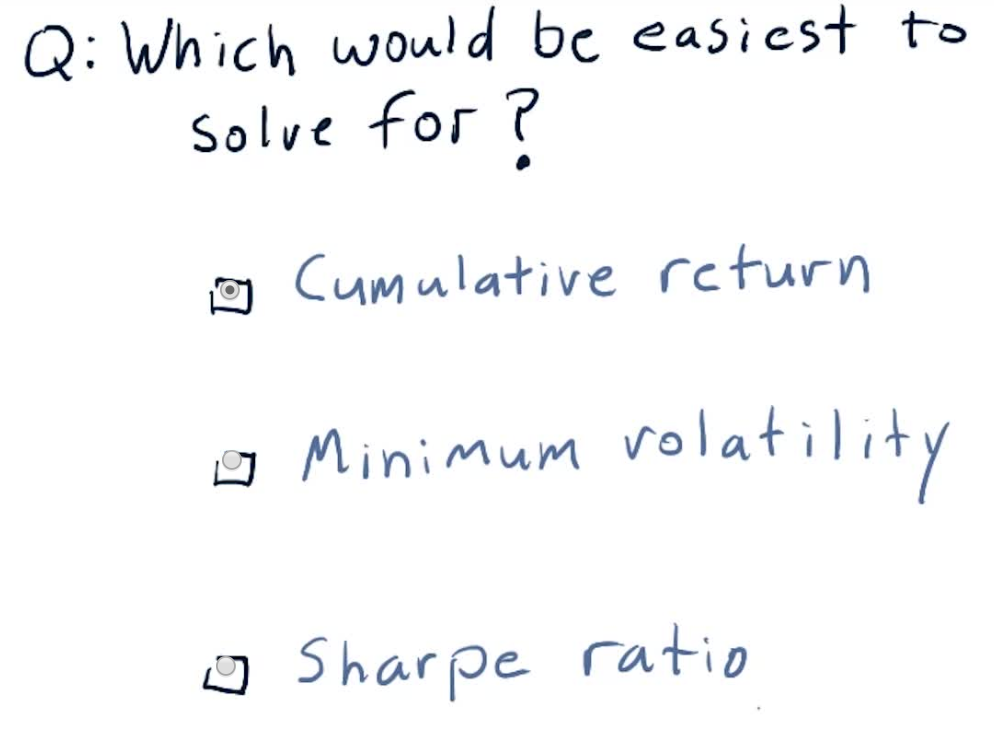

Which criteria is easiest to solve for?

Cumulative return is the most trivial measure to use - simply investing all your money in the stock with maximum return (and none in others) would be your optimal portfolio, in this case.

Hence, it is the easiest to solve for. But probably not the best for risk mitigation.

Framing the problem

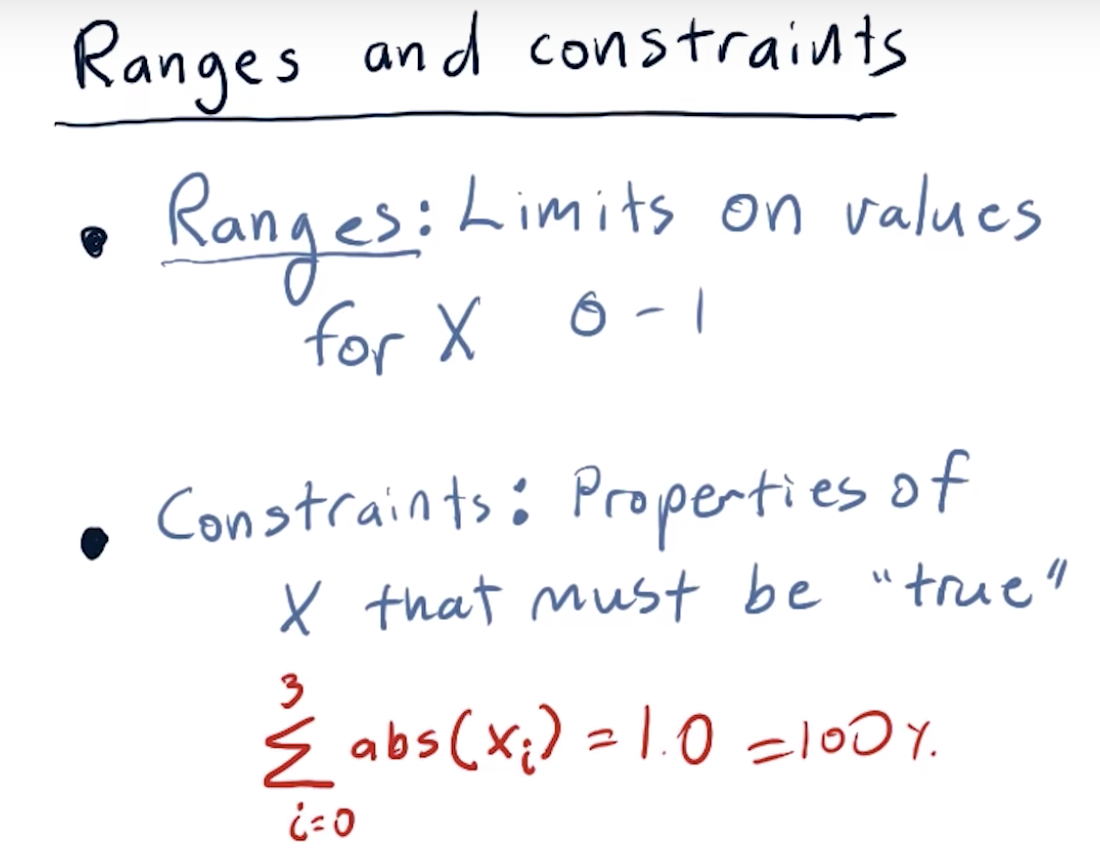

Ranges and constraints