5.Is Tether really that fiendish?

To be fair, lack of transparency doesn’t necessarily imply fraud. Except for stable currency price, Tether has other advantages, such as it allows users to send and receive dollars; transactions are not easily blocked; users don’t need any priority. However, after the attack of hackers, users were required to update their application to the latest version, and the trader became more complicated.

During the process of the transaction, Tether is able to give users confidentiality to some extent. Though Institutions that want to launch and exchange tether need to confirm its identity through approval and KYC program, but personal users only need to generate public key/private key to use tether, which is familiar with Bitcoin.

Regulators would be probably unhappy about this, and many banks would feel highly stressful when cooperate with Tether because it will break the regular rules if accept Tether as a customer, for example, the rules against money laundering. Therefore, Tether possibly tried to avoid to leak operational details to reserve banks or tried to find a small or medium-sized institution that doesn’t have a strict compliance process like a big bank.

So from a positive point of view, one of the reasons for lacking transparency in Tether may be that Tether has been looking for appropriate banks to work with and processes many bank accounts in many jurisdictions.

Besides, Tether’s supporters believe that even though Tether encounters problems, Bitfinex has enough resources to rescue it. Daily income in Bitfinex exchange would exceed 1 million during the bubble period of digital currency.(Let’s say we are selling 10,000 Bitcoin a day at $1,0000 per coin, and we take 0.1% commission from the transaction)

6. If Tether has the corresponding reserve dollar, then where are the money?

To this question, there is no official answer yet. But in term of analyzing the publicly available data, Tether may have a relationship with Puerto Rica in somehow.

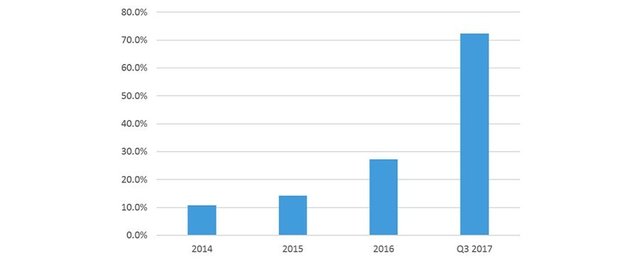

According to the existed data, Cash and deposit balances in the banking services category of IFE, Puerto Rica’s international financial entity, have grown rapidly. Except cash balances have grown highly, the proportion of cash balance in total assets have been rising. This situation is extremely unusual. Normally, banks will lend most of the assets and only keep small amounts of cash. The full reserve bank business will generate different balance sheets. Up to the end of Sept in 2017, the ratio of cash to total assets of such financial institutions in Puerto Rico has rapidly risen over 70%, indicating that there is a full reserve banking business in the region, in which this rising phenomenon is keeping.

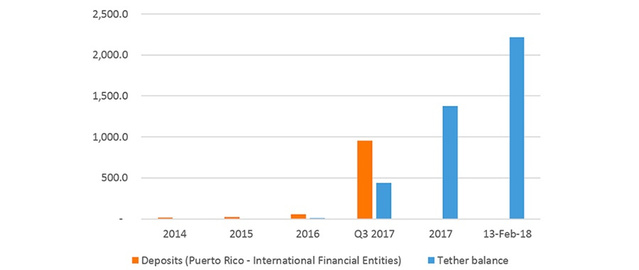

Comparing the balance of deposits in the IFI Bank category in Puerto Rico with the release value of Tether, it is nor difficult to find that there is a certain link. So society predicted that IFE banking businesses of Puerto Rico have some certain connection with USDT, otherwise with some tokens in the digital currency.

7. How do American regulators think about Tether?

Some insiders said American Commodity Futures Commission sent a subpoena to Bitfinex and Tether in Dec 12th,2017. But Bitfinex and Tether said about it in an email statement, “we regularly accept legal programs of the investigation conducted by law enforcement agency and supervision institutions, but we wouldn’t comment in any such requirement according to our policy”. Erica Richardson, a CFTC spokesman, declined to comment.

Within one hour after the news about subpoena had spread out, all encrypted currency that Coinmarketcap.com have been tracked had felled $300 billion while Bitcoin had felled to $10000 which was high-profile.

The encrypted currency community is still watching every movement of regulators. As PeterSin, co-founder of the Singapore Bitcoin club, said, the company’s tokens could quickly lose the value of Tether coin if authorities found any wrongdoing. On the scale of Tether, That was enough to cause a bloodbath in the digital money market.

8. Does Tether process the potential ability to influence the market?

The fiendish thing is many people believed and tried to prove that Tether has the ability to influence the price of Bitcoin so as to influence the entire encrypted currency market.

At the very first, people questioned the possibility of manipulating the price of Bitcoin. Famous Tether’s skeptic Bitfinex’ed posted a video in a blog and showed that a trader hangs up a huge amount of Bitcoin order, and cancel the orders when Bitcoin price is going to rise. It was mt.gox, manipulating the market in such way, which handled 70% of the world’s transactions before it went bankrupt in 2014.

Many other people and institution have once tried to approve such possibility Tether own, but those approvals failed eventually due to inadequate evidences and only set off a panic for a moment.

Why are people so worried that Tether was a scam? One thing for sure, if Tether was proved to be a “Fraud”, considering the issue of Tether manipulated by people to influence the price of Bitcoin, it would be a nuclear strike to the digital currency market which the price is already fiercely fluctuate. The anonymous author from Teherreport.com estimates that the price of bitcoin could fall 80%.