When BTC price just broke through $7000, I predicted in a previous article that it would oscillate between $6500 and $7500. The fact is that Bitcoin did run around for $7400 for a while. But a sudden plunge occurred the day before yesterday, and the current price of Bitcoin fell by more than $1,000.

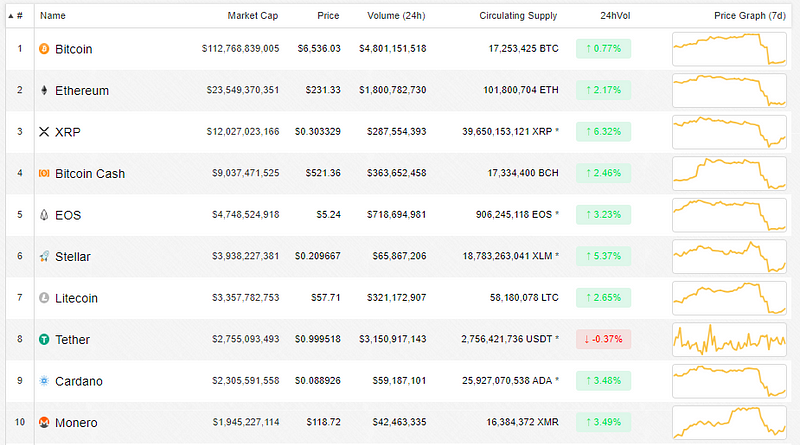

Before the article was issued, the current price of Bitcoin was $6536, which was partially recovered. What is even more frightening is that this round of bitcoin prices plummeted, which bring about a 10%-30% decline in the price of mainstream cryptocurrencies on the entire market.

There are generally several kinds of conjectures on the market for this plunge:

1. The capitalists have cashed out, it is reshuffled.

According to TokenInsight data, there were three bitcoin wallet addresses made huge transfers at the day before yesterday: Bitfinex exchange address, a temporary storage address, and Huobi exchange address, their all trading volume was more than 9,000.

What is the more frightening is that on September 3, there are 110,000 dormant bitcoins were transferred to the wallet of some exchanges, and Bitfinex was listed. Not only Bitcoin, but even Ethereum wallet has a large transfer record of 463,600 ETHs at that time.

So where did these huge transfers go?

(1) Sell, cash out

(2) Sell, buy other cryptocurrencies

But no matter which one, it is the performance of capitalists withdrawal from the market for the bitcoin, it will cause a crit on the price of bitcoin, which made bitcoin price get loss of 20%.

2. Panic selling

According to current data, the entire bitcoin market is in a very strong negative state. Because so far, there are not so many people have done a bargain-hunting operation on Bitcoin. This also just proves that the market was in a state of “extreme panic”, and this year, the panic index of the market averaged around 18, which is already a long-term panic.

Once one person chooses to sell Bitcoin, then a large number of people will be also anxious to sell. Everyone is afraid that they will be stuck here. Moreover, if the price of this currency is so unstable, and HODLers hold this currency for a long time, it will only aggravate the panic of them.

Therefore, most people choose to sell when the price of the currency is slightly declined. All of this can be explained by the famous lines in the Game of Thrones: “Winter is coming.”

3. Trends in other currencies

First, when Bitcoin prices plummeted, many other currencies experienced a certain degree of the plunge. Among them, the panic selling of ETH is most obvious. Probably because ICO was banned by many governments, the ETH that nearly monopolized the entire ICO industry was abandoned by most of the project parties. Then let’s start with ETH:

(1) ETH

The rising trend of ETH is very weak. The bitcoin plunged, which causing ETH to directly fall below the lowest price in this year, even as low as $204. The symmetrical triangle that had been painstakingly constructed for many days was easily broken. This suggests that ETH price may continue to fall, but with a minimum of $150 long-term support.

(2) XRP

Yesterday, XRP price fell sharply, falling below the support levels of $0.3200 and $0.3000. On the XRP to USD hourly chart, the support for the downtrend channel has also been broken. Today, XRP continued to fall below the support level of $0.2800, once as low as $0.2600. Technically, there may be a small rebound, but it is difficult to break through $0.3000 again.

(3) BCH

BCH price has fallen sharply following bitcoin. A key bearish trend line appears on the BCH/USD hourly chart with resistance at $525. BCH fell more than $100 from its high point and fell below $500 after rebounding around $525. It has completely broken its position and the support levels are $470.

(4) EOS

The EOS price of the upswing sharply fell from $6.8 to about $5. The support levels are $4, which is the legendary “iron bottom”