纳税光荣

北京2020年后纳税规则调整如下

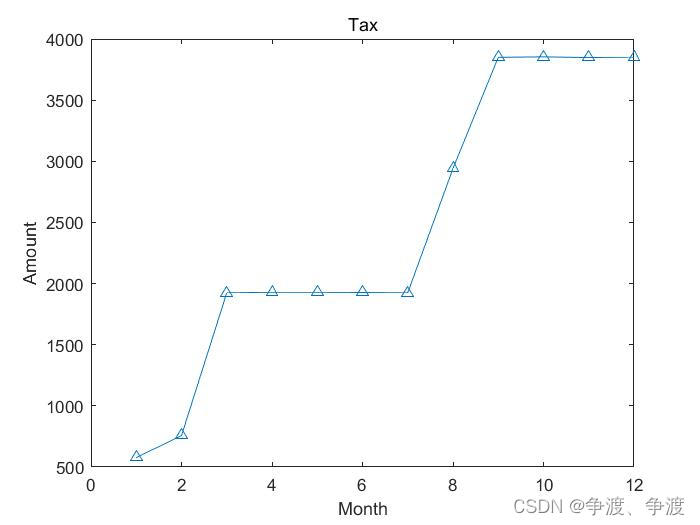

假设某互联网公司程序员收入月入3个W;基础5000和各种免税向后计算程序如下:(按照12个月算,奖金、年终奖未计算在内。。。)

clc;clear;

close all;

Salary = [30250,30290,30240,30290,30290,30270,30240,30270,30250,30270,30240,30260]; % 每个月工资

LeastNumber = 5000; % 免税工资

InsuranceAndFund = 4500; % 五险一金

Rent = 1500; % 租房减免

t = 1:12;

EffectiveSalary = Salary-LeastNumber-InsuranceAndFund-Rent; % 需要纳税的额度

TaxPersent = [0.03,0.1,0.2,0.25,0.3,0.35,0.45]; % 纳税比例

TaxGate = [3.6e4,1.44e5,3e5,4.2e5,6.6e5,9.6e5]; % 纳税阶段

MaxGate = TaxPersent(1:end-1).*(TaxGate-[0,TaxGate(1:end-1)]); % 每个阶段纳税的上限

SumNumber = cumsum(MaxGate);

SumSalary = 0;

MidTax = 0;

SumTax = zeros(1,12);

for i = 1:12

SumSalary = SumSalary+EffectiveSalary(i);

if SumSalary<TaxGate(1)

MonthTax = SumSalary*TaxPersent(1);

elseif SumSalary>TaxGate(1) && SumSalary<TaxGate(2)

MonthTax = (SumSalary-TaxGate(1))*TaxPersent(2)+SumNumber(1);

elseif SumSalary>TaxGate(2) && SumSalary<TaxGate(3)

MonthTax = (SumSalary-TaxGate(2))*TaxPersent(3)+SumNumber(2);

elseif SumSalary>TaxGate(3) && SumSalary<TaxGate(4)

MonthTax = (SumSalary-TaxGate(3))*TaxPersent(4)+SumNumber(3);

elseif SumSalary>TaxGate(4) && SumSalary<TaxGate(5)

MonthTax = (SumSalary-TaxGate(4))*TaxPersent(5)+SumNumber(4);

elseif SumSalary>TaxGate(5) && SumSalary<TaxGate(6)

MonthTax = (SumSalary-TaxGate(5))*TaxPersent(6)+SumNumber(5);

else

MonthTax = (SumSalary-TaxGate(6))*TaxPersent(7)+SumNumber(6);

end

SumTax(i) = MonthTax-MidTax;

MidTax = MonthTax;

end

figure,b = plot(t,SumTax,'^-');

title('Tax');

xlabel('Month');

ylabel('Amount');

YearTax = sum(SumTax); % 纳税总额

AllSalary = sum(Salary)-YearTax-InsuranceAndFund*12; % 收入总额

可以看出,该程序员总需要纳税3个多W。纳税大户!