In the era of digital economy, data-driven business innovation and development has become the main choice of enterprises, and fund industry institutions are also actively promoting digital transformation, but opportunities and challenges coexist. To convert data into data elements , systematic data capacity building is needed as a catalyst.

The fund industry also shows certain pain points, which are manifested as insufficient data security protection, lack of data context, and data quality cannot be guaranteed. At the same time, due to the lack of understanding of the importance of data management and the accumulation of messy data over the years during the system construction in the industry, it is difficult to advance the data governance work, resulting in long-term duplication of customers at the marketing, analysis, and regulatory reporting ends. Exceptions etc.

Under the guidance of the company's "14th Five-Year" digital development plan, the fund company insists on overall planning, focusing on pain points, strengthening data capacity building, and continuing to make efforts in improving the data governance system, building big data technology, and improving data service capabilities . Taking measures simultaneously, we have gradually explored and formed a road of data capacity building governance that is in line with the fund's own characteristics.

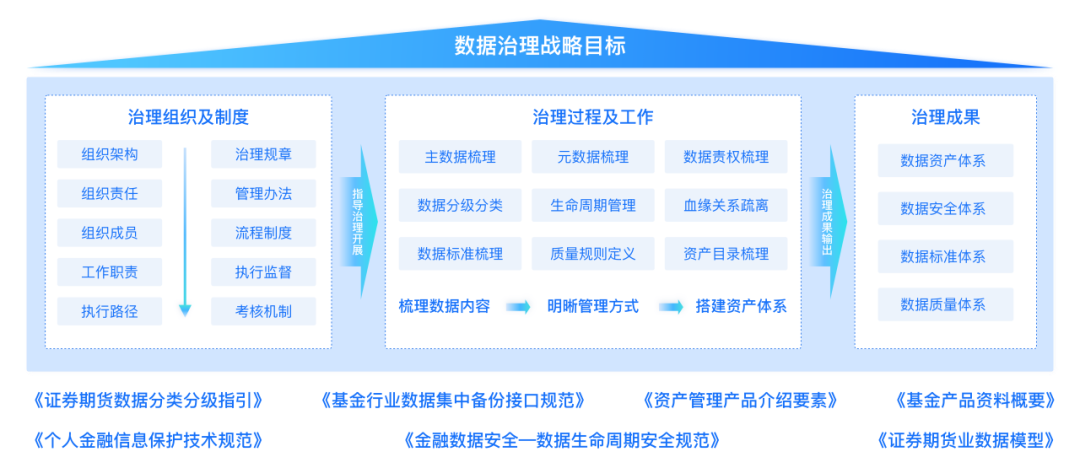

Fund company data governance solution

Build a data governance system for the fund industry around regulatory norms

The first is to improve the governance organization: establish a sound data governance organizational structure , implement the organization's responsibilities and functions in the governance work, support data governance related systems, and promote the implementation of data governance work.

The second is to build an asset system: sort out the global business data to clarify the meaning of each attribute, and manage the data through classification and management in the form of asset catalogs to realize data visibility, usability, and manageability, and comprehensively quantify the value of data.

The third is to improve data quality: According to the relevant regulations of financial supervision, formulate data standards and relevant data inspection regulations, improve data quality and improve data availability through data standardization.

The fourth is to strengthen data security: build a security system around policies and regulations related to data security, fully consider the relationship between data, and implement full-link security management through grading, encryption and other means .

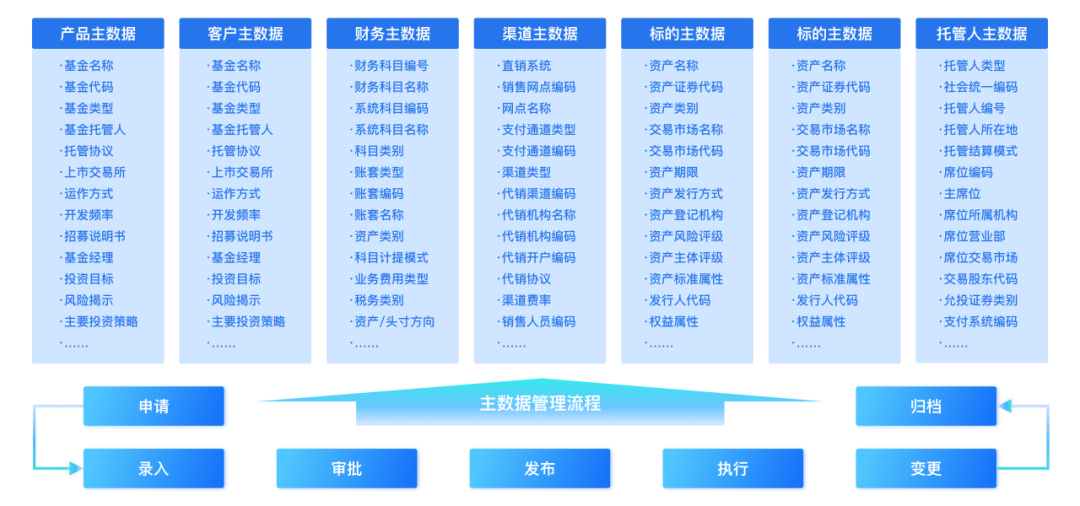

The fifth is the unification of master data: the company-level master data system is organized by standardizing all elements of the fund to ensure that the basic business information of the fund maintains consistency, accuracy, completeness, and controllability in the entire scope.

Realize fund master data management based on all elements of asset management

Master data is used to describe the data of the core business entity of the fund. What master data management needs to do is to integrate the most core and most shared data (master data) from the company's multiple business systems, and centralize data cleaning and enrichment. , and distribute unified, complete, accurate, and authoritative master data to operational and analytical applications that need to use these data across the enterprise, including various business systems, business processes, and decisions support system etc.

The integrity and accuracy of master data determine the ability of enterprise data sharing , direct communication and application. The main body of master data in the fund industry is divided into: customer master data, securities master data, and product master data. The priority of customer information integration from different sources is the focus of customer master data governance; choosing the service provider with the best data quality as the main focus, combined with other data sources for cross-validation is the focus of securities master data governance; determining the ownership of each product element, who Who is responsible for the quality of production data, the owner formulates quality standards, and the system strictly controls access is the focus of product master data governance.

The regulatory reporting data of the three major reporting entities, the China Securities Regulatory Commission, the People's Bank of China, and the Fund Industry Association, has the characteristics of multiple dimensions, clear standards, and high data quality requirements. By building relevant master data, it provides a strong line of defense for multiple regulatory requirements such as anti-money laundering, credit reporting, and interest rates.

Build an enterprise-level data asset center based on metadata

Connect to the data warehouse of the fund company and various business system libraries, collect the metadata of the database tables, and obtain the metadata information used by the data ; then, on the basis of the collection, perform secondary standard maintenance, supplement the missing business metadata, and provide after summary Metadata query analysis service .

Formulate data standards for fund companies, and through standard mapping and comparison, find and modify data that does not meet the standards. Then through the standardized table building and modeling of the data model, it is standard to let the incremental data land. Through the automatic analysis of data blood relationship, it can assist technical and business personnel to discover data flow relationship and data influence link, and reasonably subscribe and maintain the data that users care about.

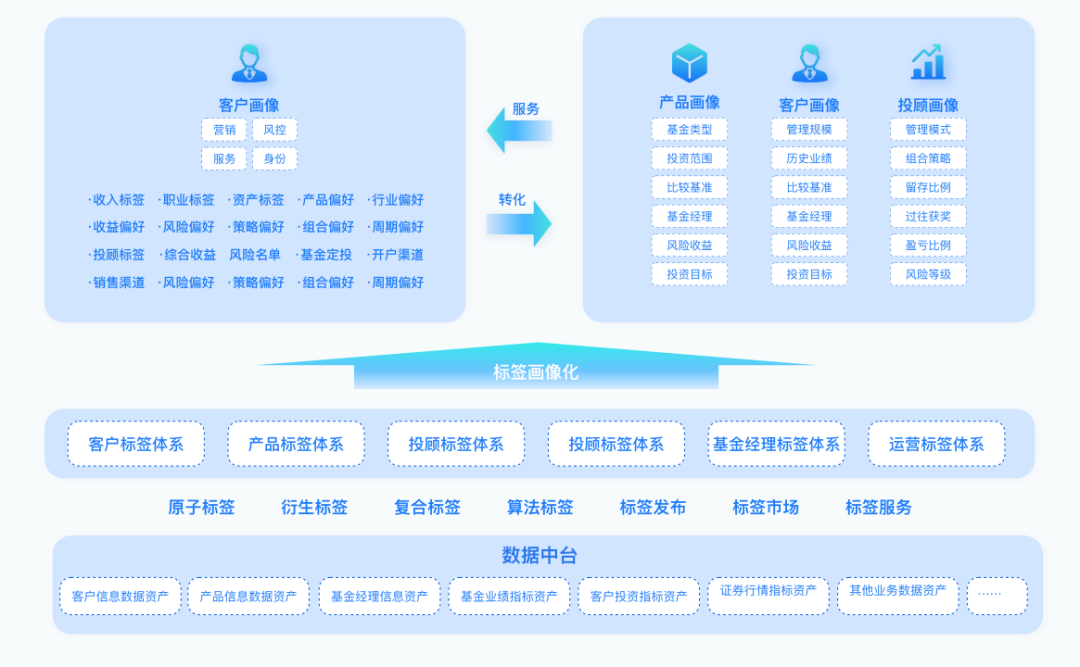

Build a full-dimensional portrait system around the fund business

In recent years, as investors' demand for professional asset management has become increasingly strong, competition in the asset management industry has also intensified, which has forced fund companies to focus on investor education and companionship. The digital marketing capabilities of fund companies have gradually become the key competitiveness of enterprises, but the main difficulties in the construction process are as follows:

First, the foundation is weak. Due to the large number of public offering fund customers, and the long-term sales of public offering funds rely on consignment channels and Internet channels, customer data is scattered and multi-terminal identities are not unified, which leads to limited ability of fund companies to understand their own customers and lack of demand for investors. Effective research tools for change and behavior change.

The second is that it is difficult to match. Through a large number of questionnaires and data analysis, it is found that investors with different groups of people and different needs have obvious differences in product requirements and income targets, and their operating behaviors are also significantly different. This requires fund companies to have the ability to identify effective customer segments, the ability to refine product recommendations, and the ability to differentiate investment education content, thereby improving investors' investment experience. However, due to the weak closed-loop capability of the marketing system, it is difficult to know whether fund products meet the needs of users and improve the investment experience.

The third is shallow application. In the face of problems such as unscientific and unsystematic indicators, insufficient depth of data analysis, and lack of business insights and suggestions, many companies stop at the stage of having data and looking at data, and have not combined data analysis with marketing business. Meaningful insights and recommendations.

Through the Kangaroo Cloud customer data insight platform , a three-tier labeling system involving customers, products, and channels is established to support the needs of different perspectives such as sales, service, and compliance, and to support convenient full lifecycle management of label development, calculation, display, and output. , continuously output data value, support individual customer and group portraits , customer group circle selection and comparison, support rapid promotion, intelligent marketing, precise service, fine-grained label authority management and efficient and stable label display and output, ensuring safety and efficiency Business development, building block-style component label construction and reuse, can quickly support routine, temporary or thematic data analysis

Achievements of Fund Company Data Governance Construction

data management

Considering that data governance is a long-term process of accumulating data knowledge and culture in a company, after a comprehensive comparison and evaluation, the fund company combined its own organizational structure and data situation, took the Information Technology Governance Committee as the leading organization for data governance, and composed of its own personnel The Data Governance Group is the promotion organization for the construction of data governance and landing platforms, and promotes the release of data governance related systems and the implementation of governance.

In terms of system, the "Data Management Measures", "Guiding Principles for Data Classification and Grading" and other system specifications have been issued successively. In the construction of the platform, the digital asset management platform is used as the landing support platform for data governance, which realizes data standard management, master data management, metadata management, data change management, digital asset inventory , data quality management, data classification and classification, and data management. Management functions such as blood relationship analysis closely combine data governance with the development and design process to form a management closed loop of data model change design, review, post-event audit, and regular quantitative scoring. Data governance is the starting point to ensure data integrity, accuracy, and consistency To form a long-term mechanism for data quality improvement.

The company promotes the implementation of data governance in accordance with the " point, line, surface and body " method, starting from the data source system for comprehensive governance, and abandoning the temporary solution of "treating the head if you have a headache, and treating the foot if you have a pain". The point is to manage the point-shaped self-developed business systems one by one, the line is to promote data and process interoperability between systems, the surface is to combine the idea of building a large platform system, and improve the governance system from the overall perspective of business support fundamentals, and the body is to finally build data Shared and interconnected high-quality data system.

The current digital asset management platform has covered 40 systems, and has achieved a data standard coverage rate of more than 95% for newly added or reconstructed systems.

In terms of capabilities

Middle-end capabilities are a comprehensive reflection of the company's internal shared resources that can provide business, technology, and data capabilities. The business of fund companies is relatively stable. Building stable middle-office capabilities meets the needs of fund companies. Strengthening middle-office sharing capabilities and accumulating business and service capabilities will be the core competitiveness in the future.

The company maps business capabilities, technical capabilities, and data capabilities into three major technical capabilities of business middle platform, technology middle platform, and data middle platform from a technical perspective. Through the close cooperation of the three, it fully empowers business operations.

One is the business center: currently providing fund sales services to millions of customers. In order to improve system delivery speed and delivery quality, and better provide customers with accurate and considerate services, the company sorts out and abstracts all services carried by the data governance platform , adopts container + microservice technology architecture , and refines and disassembles services according to business domains. Gradually accumulate middle-office service capabilities such as marketing services and investment advisory services, and reduce the waste of resources caused by the construction and maintenance of repetitive system functions. At the same time, under the premise of obtaining the authorization of customers, historical transaction behavior, personal asset distribution, investment risk preference and other information, using the big data AI algorithm capabilities provided by the technology center platform , provide historical profit and loss analysis for customers with different preferences and investment styles. Behavior diagnosis, fixed investment strategy advice and other personalized services.

Using the technical architecture of micro-service + micro-front end, the operation management services in the middle and back-end operation support systems such as TA, valuation, and fund settlement are collected and integrated, and the daily work of the registration and settlement department (such as: task assignment, teamwork, and dividend distribution) is realized. Item follow-up, etc.) centralized, standardized and unified management, through the precipitation of operational management data assets, combined with large-screen visual display of operational management , to make operational management more intuitive and efficient, to drive operational efficiency with data, and to effectively avoid routine Risks and issues in operations.

The second is the technology center: In order to unify the development of technology stacks and avoid repeated "wheel-making" on public technology tools during the construction of various systems, the department has established a technology center team, which is responsible for the precipitation and construction of public service capabilities, the introduction of new technologies, Architecture review and other work, through the output of standardized general capabilities, empowers the construction of various business systems, which mainly includes application technology empowerment and AI algorithm empowerment.

The current technology platform has released public technology services such as message delivery service, unified printing service, unified data gateway , service registration center, workflow engine, and AI intelligent services such as NLP, machine learning related algorithms, and intelligent robots. These services have been widely used. It is applied to multiple downstream business systems such as product management system, integration of investment and research, intelligent customer service, and collaborative office platform.

The third is the data center: based on the Hadoop technology ecosystem, the company adopts a data technology architecture integrating lakes and warehouses to build a company-level data lake and data warehouse. According to the relevant data standards and specifications formulated by data governance, the business data is unified by theme Cleanse, integrate. At the same time, in order to ensure the consistency of data export and improve the security of data storage and consumption, the company adopts the micro-service architecture based on the standard data after data warehouse cleaning and integration, and realizes the development, testing, verification, release, authorization, and offline of data service interfaces. Full life cycle online management, data empowerment for various data consumption scenarios with online data service interface.

In addition, with the help of data governance, sort out and calibrate various indicators, clarify the definition and statistical caliber of indicators, build a global indicator system, unify data export standards, realize "counting one hole", and avoid "data fights" in different data consumption scenarios The problem.

"Dutstack Product White Paper": https://www.dtstack.com/resources/1004?src=szsm

"Data Governance Industry Practice White Paper" download address: https://www.dtstack.com/resources/1001?src=szsm If you want to know or consult more about Kangaroo Cloud big data products, industry solutions, and customer cases, visit Kangaroo Cloud official website: https://www.dtstack.com/?src=szkyzg

At the same time, students who are interested in big data open source projects are welcome to join "Kangaroo Cloud Open Source Framework DingTalk Technology qun" to exchange the latest open source technology information, qun number: 30537511, project address: https://github.com/DTStack

Ministry of Industry and Information Technology: Do not provide network access services for unregistered apps Go 1.21 officially released Ruan Yifeng released " TypeScript Tutorial" Bram Moolenaar, the father of Vim, passed away due to illness The self-developed kernel Linus personally reviewed the code, hoping to calm down the "infighting" driven by the Bcachefs file system. ByteDance launched a public DNS service . Excellent, committed to the Linux kernel mainline this month