Calculation report

PVC index daily PVC multi-factor-------------------------------

| name | all transactions | long | short |

|---|---|---|---|

| report generation time | 2017/03/11 21:33:00 | ||

| Amount of funds allocated | 500000 | ||

| data contract | PVC Index | ||

| trading contract | PVC Index | ||

| K line cycle | day line | ||

| Data start time | 2009-5-25 | ||

| data end time | 2017-3-10 | ||

| Signal calculation start time | 2009-5-25 | ||

| Signal calculation end time | 2017-3-10 | ||

| unit | 5 (ton/lot, yuan/point) | ||

| Margin | 8.00% | ||

| handling fee | 0.00 yuan/hand | ||

| slippage | 0 | ||

| Open lot | 1 | ||

| Initial capital ratio | 0.66% | ||

| Model | PVC multi-factor | ||

| parameter | [0,0,0,0,0,0] | ||

| name | all transactions | long | short |

| test days | 2847 | ||

| number of test cycles | 1895 | ||

| number of signals | 56 | ||

| total number of instructions | 56 | ||

| Number of signal disappearances | 0 | ||

| Amount of funds allocated | 500000 | ||

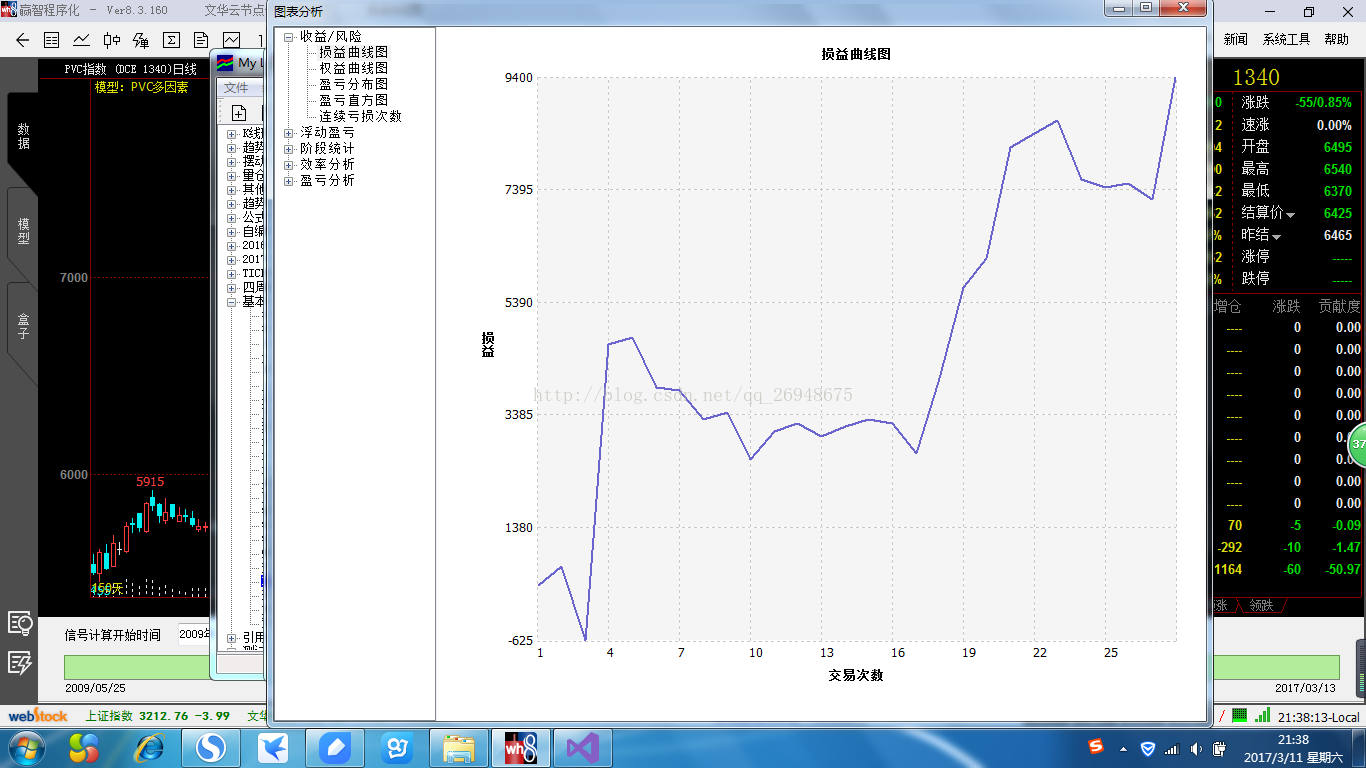

| final interest | 509400 | ||

| Number of short positions | 1398 | ||

| The longest continuous short position period | 455 | ||

| longest trading cycle | 71 | ||

| standard deviation | 1248.10 | ||

| standard deviation | 371.77% | ||

| Sharpe ratio | -14.09 | ||

| Average profit and loss/average loss | 0.62 | ||

| Equity maximum drawdown | 4210.00 | ||

| Equity maximum drawdown time | 2012/09/14 | ||

| Equity maximum drawdown ratio | 0.83% | ||

| Equity maximum drawdown ratio time | 2012/09/14 | ||

| The longest period of equity without a new high | 574 | ||

| The longest period of equity without a new high | 2011/10/20 - 2014/03/07 | ||

| Profit and loss maximum drawdown | 2185.00 | ||

| Profit and loss maximum drawdown time | 2012/09/18 | ||

| Profit and loss maximum drawdown ratio | 0.43% | ||

| Profit and loss maximum drawdown ratio time | 2012/09/18 | ||

| The longest period of profit and loss without a new high | 452 | ||

| The longest period of profit and loss without a new high | 2011/12/22 - 2013/11/12 | ||

| Risk rate | 0.22% | ||

| rate of return/risk | 1.11 | ||

| Maximum loss per lot | 1300.00 | ||

| Average profit and loss per lot | 335.71 | ||

| Profitability | 1.88% | 0.00% | 1.88% |

| Annualized Simple Interest Yield | 0.24% | ||

| Monthly Simple Interest Yield | 0.02% | ||

| Annual compounded rate of return | 0.24% | ||

| monthly compounded rate of return | 0.02% | ||

| win rate | 60.71% | ||

| model score | 62 points | ||

| Average profit/equity maximum drawdown | 0.21 | ||

| Average profit/average loss | 1.67 | ∞ | 1.67 |

| Average Profit Rate / Average Loss Rate | 1.68 | ||

| net profit | 9400 | 0 | 9400 |

| total profit | 15325.00 | 0.00 | 15325.00 |

| total loss | 5925.00 | 0.00 | 5925.00 |

| Total Profit/Total Loss | 2.59 | ∞ | 2.59 |

| Among them, the positions are floating profit | 0.00 | 0.00 | 0.00 |

| number of transactions | 28 | 0 | 28 |

| Profit ratio | 60.71% | 0.00% | 60.71% |

| Profits | 17 | 0 | 17 |

| Number of losses | 11 | 0 | 11 |

| Number of flats | 0 | 0 | 0 |

| Average trading cycle | 67.68 | 0.00 | 67.68 |

| Average Profitable Trading Cycle | 111.47 | 0.00 | 111.47 |

| 平均亏损交易周期 | 172.27 | 0.00 | 172.27 |

| 平均盈亏(利润) | 335.71 | 0.00 | 335.71 |

| 平均盈利 | 901.47 | 0.00 | 901.47 |

| 平均亏损 | 538.64 | 0.00 | 538.64 |

| 最大盈利 | 5270.00 | 0.00 | 5270.00 |

| 最大亏损 | 1300.00 | 0.00 | 1300.00 |

| 最大盈利/总盈利 | 0.34 | ∞ | 0.34 |

| 最大亏损/总亏损 | 0.22 | ∞ | 0.22 |

| 净利润/最大亏损 | 7.23 | ∞ | 7.23 |

| 最大盈利时间 | 2011/11/16 | -- | 2011/11/16 |

| 最大亏损时间 | 2011/08/03 | -- | 2011/08/03 |

| 最大持续盈利次数 | 6 | 0 | 6 |

| 最大持续盈利次数出现时间 | 2013/11/13 - 2015/02/06 | ||

| 最大持续亏损次数 | 3 | 0 | 3 |

| 最大持续亏损次数出现时间 | 2012/02/08 - 2012/06/18 | ||

| 平均持仓手数 | 1 | ||

| 最大持仓手数 | 1 | ||

| 平均使用资金额 | 2596.24 | ||

| 最大使用资金额 | 3294.80 | ||

| 平均资金使用率 | 0.51% | ||

| 最大资金使用率 | 0.66% | ||

| 扣除最大盈利后收益率 | 0.83% | 0.00% | 0.83% |

| 扣除最大亏损后收益率 | 2.14% | 0.00% | 2.14% |

| 期间最大权益 | 510100 | ||

| 期间最小权益 | 498910 | ||

| 手续费 | 0 | ||

| 滑点损耗 | 0 | ||

| 成交额 | 1805470 | ||