Laser financial news one hundred million official micro letter April 3 United Bank today released the 2019 results.

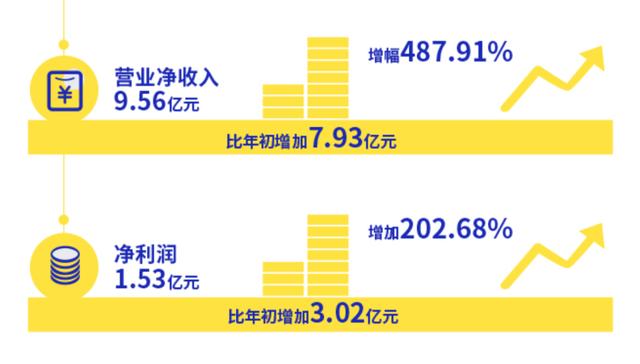

2019 billion of net income of 956 million yuan banking business, an increase over the beginning of 793 million yuan, an increase of 487.91%. Net profit of 153 million yuan, 302 million yuan over the beginning of an increase, an increase of 202.68%.

It is noteworthy that, billion of bank profitability in the first half of 2019, net profit of 50.62 million yuan, net operating income of 451 million yuan. From this perspective, net revenues in the second half of 2019 billion of Bank of 505 million yuan, net profit of 102 million yuan, more than 95 million yuan in annual net profit target.

Data show that as of December 31, 2019, total bank assets billion of 31.321 billion yuan, 17.886 billion yuan over the beginning of an increase, an increase of 133.12%. Deposit balance of 25.058 billion yuan, 16.401 billion yuan over the beginning of an increase, an increase of 189.47%. Loan balance of 20.25 billion yuan, 15.06 billion yuan over the beginning of an increase, an increase of 290.14%.

2019 billion of the bank in cooperation with the US group, Baidu, Jingdong, consumer credit business put in a total of 73.9 billion yuan the year, serving over 6.09 million customers, a total of more than 15 million credit customers.

The first half of 2019 showed a profit, Yealink banks to strengthen cooperation with the United States Mission reviews, Jingdong finance, financial head of Xiaoman Internet platform to promote "Yealink easy loan" online consumer lending, and promote consumer finance business grew rapidly. From the fruitful cooperation of view, the US group 2.69 million new customers, new loans of about 9.7 billion yuan; Jingdong 6.87 million new customers, new loans of about 1.9 billion yuan; Baidu over 100,000 new customers, new loans turnover of about 345 million yuan.

Laser Finance noted that in 2019, Yealink Bank's "100 million tax credit" line of personal business loans, supply chain financial products "100 million commercial loan" to achieve a total small and micro business loans 230 million yuan; "100 million agricultural credit" for farmers credit 160 million yuan, 130 million yuan in the loan balance.

Enterprises look shows that Yealink Bank was established in May 3, 2017, the registered capital of 20 million yuan, the legal representative of Dai Hao. Dai Hao in the same issue financial holding legal representative, the chairman, the actual control people.

Billion Bank is the largest shareholder in the hair Holding Investment Management Co., Ltd. (referred to as the hair FHC), holding 30%. The second largest shareholder of Jilin three fast Technology Co., Ltd. (referred to as the US group), holding 28.5%. The third largest shareholder of Jilin Huayang Group Co., Ltd., holding 9.9%. The remaining four companies hold the remaining 31.6% stake.

As the second largest shareholder, the US group with close ties billion of the bank. Billion Bank is a "US group living" fund provider, has launched a user acquisition channels by US corporations and other loan products - Billion easy loan.

The first half of 2019 showed a profit, Yealink Bank has partnered with the US group, Jingdong, Xiaoman degree in finance, financial millet, Wearnes Branch, 51 credit cards, the United States financial, land and gold, Union Branch and other platforms.

[This article original works by the Finance〗 〖laser, Reprinted authorized. ]