March 2018, the Third Plenum of the Party's ninth consideration by the "CPC Central Committee on deepening the reform of the party and state institutions," pointed out: "The basic pension insurance, basic medical insurance, unemployment insurance and other social unified collection of insurance premiums referred to the tax authorities. "for the tax department," unified collection of "social insurance will face many new problems and challenges. A key question is: how social insurance contribution base to determine the caliber? In this regard, it analyzes more than a dozen foreign representative countries (regions) of social insurance (tax) fee (tax) base by contrast, put forward ideas and proposals for fee-based reform of social insurance premiums.

Currently, most countries in order to protect workers in old age, illness, can be obtained from the corresponding social benefits when disability and unemployment, are taking a reasonable way to raise social security funds from parties and other business or employment. Although the purpose of raising funds, properties, uses basically the same, but because of different national taxation system, so that funds are not the same name. Some countries called the "Social Security taxes", such as the US elderly, survivors and disability insurance tax (Old-Age, Survivors and Disability Insurance Tax), Medicare tax (Hospital Insurance Tax / Medicare) and unemployment insurance tax (Unemployment Tax); some countries as "social insurance", such as China's pension insurance, medical insurance, work injury insurance, unemployment insurance, maternity insurance and other; there are countries, calls "social security contributions "as the UK's National Insurance contributions (National Insurance contributions). In order to facilitate comparative analysis of this paper, the above call to unity "social insurance."

First, the social insurance base international comparisons

as of June 30, 2017, the introduction of social insurance premiums worldwide has reached 205 countries and territories. According to the national welfare system, the amount of the economy, population and ground source close to the Chinese and other factors, we selected 11 representative countries (regions), the social insurance, tax base were compared, including the Nordic welfare country Finland and Denmark, developed countries Britain, France, the United States and Japan, developing countries like India and Indonesia, as well as mainland Chinese culture similar to Singapore, Hong Kong and China Taiwan region.

(A) 11 countries (regions) of social insurance base of the main provisions of

Finland: Finnish social insurance includes five, namely: health insurance (Health Insurance Contribution), pension (Pension Insurance Contribution), unemployment insurance (Unemployment Insurance Contribution), accident Insurance (accident Insurance Contribution) and group life insurance (Group Life Insurance Contribution). According to the employer in total compensation paid to employees (Annual Gross Remuneration), to pay a certain percentage of the previous five social insurance. Total remuneration paid employees made before 3 by a certain percentage of social insurance by employers withholding. The aforementioned total remuneration, including salary, benefits, allowances, pension income, employee incentive, as well as work-related performance bonus or dividend income. Self-employed on their own calculated and paid health insurance, pension insurance and unemployment insurance according to their income, their income refers deserved income self-employed persons in line with pay, insurance providers and self-employed persons according to "self-employed pension law" the relevant provisions of the income of the previous year indices and individual operators to determine social insurance base.

Denmark: The Danish labor market, including social insurance contributions (Labour Market Contribution) and supplementary pension contributions (ATP-Arbejdsmarkedets Till & # 230; gspension, ie the Annual Supplementary Pension Contribution). Labor market contributions made in accordance with the employment office of all remuneration related (Any Kind of Remuneration Paid in Respect of the Employment) is calculated and paid by the employee by the employer withheld. Employment-related remuneration, including salary, benefits in kind (such as: company cars, calls, journal subscriptions, etc.), equity incentives, severance pay. Supplementary pension contributions take the form of a fixed levy, paid by employers and co-workers, employers pay 189.35 DKK per month for each full-time employees, full-time employees to pay DKK 94.65 per person per month, by the employer for withholding. Individual operators fixed monthly payment of 284 DKK supplementary pension contributions and fixed-rate payment of labor market contributions, labor market, social insurance contribution base for the self-employed can deduct the balance of revenue and expenditure.

UK: Social Insurance (National Insurance Contributions), a total of six collection classes, including a class 1 (Primary Class1), two Class 1 (Secondary Class1), 1A class (Class 1A), 1B class (Class 1B ), class (class 2) 2, 3 classes (class 3) and 4 classes (class 4). Employers, employees and self-employed persons respectively, according to the above categories pay social insurance premiums. According to the employer confirmed that the total salaries and wages paid to employees to pay two Class 1, 1A and 1B class class social insurance program, employees pay a social insurance contribution class 1 on the total amount of wages and salaries by the employer withholding. Previous wage payroll means without any tax deduction of wages and salaries and other remuneration received total employees, including wages and salaries, retired staff salaries, benefits in kind, bullion, commodities, other sale of property, equity incentives, pension income, directors fees. Self-employed are required to pay a Class 2 rating and fixed-rate payment of social insurance four categories of social insurance contributions in the case of income to meet the conditions, the four categories of social insurance premiums to the annual income of the self-employed as a social insurance base.

France: France's current social insurance system is very complex, composed of a number of social insurance system. Among them, the general social insurance system applicable to the employee's most extensive, covering the majority of employees in the non-agricultural industries. In general, the employee social insurance system, according to the employer to pay wages and salaries paid to employees of the total income (Gross Salary) Health and Welfare (Health Benefits), old-age pensions (Old-Age Pension), family allowances (Family Allowance), injury Disease compensation (Work-Related Injury and Sickness compensation), supplementary pensions (supplementary pension) and other social insurance programs. Employees then pay old-age pensions, supplementary pensions and other social insurance programs. General employee social insurance system the purpose of social insurance base wages and salaries for employees of the total income, including wages and salaries, fringe benefits, bonuses, commissions, remuneration derived from profit sharing plan, the employer's contribution of supplementary health insurance plans ; if the employee has worked with other employment-related income from third parties for direct payments should also calculate and pay social insurance premiums as a base. To individual operators, the main items include payment of medical benefits, family allowances and old age pensions, according to the scale of operation in order to profit after all expenses total annual income or as a deduction of social insurance base. In addition, in order to expand the scope of social insurance levy, the French government has also introduced three additional social insurance contributions, including social contributions (Social Levy), generalized social contributions (Generalized Social Contribution) and liabilities of social insurance contributions ( Social Security Debt Contribution), the purpose of the employee wage and salary income and income other than the production of self-employed business income included in the scope of the collection of social insurance, including but not limited to their base salary, pension and unemployment benefits, personal services income, agriculture income, royalty income, property investment income, capital gains sale of property (including real estate, collections, automobiles, furniture, etc.), as well as specific interest income.

US: social insurance includes old-age, survivors, disability insurance (Old-Age, Survivors and Disability Insurance Tax), health insurance (Hospital Insurance Tax / Medicare) and unemployment insurance (Unemployment Tax). According to the employer to pay the wages paid to employees of old age, survivors, disability insurance, medical insurance and unemployment insurance, employee salaries paid by old age, survivors, disability insurance, taxes and Medicare taxes from their employer withholding. Wages refers to all forms of employment that employees were receiving compensation, including wages and salaries, commissions, tips, bonuses, and other taxable employee benefits, excluding special items due to the acquisition of a particular disease, disability and death, and tax-exempt employee benefits. Self-employed need to net income as a social insurance base, to pay old-age, survivors, disability insurance, medical insurance and unemployment insurance, net income refers to the income obtained from the self-employed trade, business minus the balance after deducting expenses related permit , the total number from trading business partnership share of revenue.

Japan: Japan's social insurance including health insurance, pension insurance and labor insurance. Employer under the standard monthly remuneration paid to employees of social insurance base, to pay employee health insurance (Employee Health Insurance), employee pension benefits Insurance (Employee Welfare Pension Insurance), Employment Insurance (Employment Insurance), employee accident insurance (workers' Accident Insurance) and gold child support payments (child-raising contribution). Employees according to their standard monthly remuneration paid employee health insurance, employee pension insurance and employment insurance benefits by the employer withholding. Standard monthly remuneration for the month including wages, bonuses, allowances (such as commuting, overtime, accommodation, meals, etc.), etc., of the total. Self-employed are required to pay a fixed insured and the National Health Insurance (National Health Insurance) and National Pension (National Pension Insurance).

India: India's social insurance includes employees provident fund (Employees 'Provident Fund), employee pension plan (Employees' Pension Scheme), employees National Insurance Scheme (Employees 'State Insurance Scheme), employee savings association of insurance (ie survivors' insurance, Employees 'Deposit-Linked Insurance Scheme) and the national pension plan (National Pension Scheme) and so on. Employees Provident Fund, the national insurance scheme and the national pension plan shared by employers and employees, with wages and salaries for the social insurance base, employee pension plans and savings associated with the insurance paid by the employer. Above wages and salaries paid by the employer including salary, benefits in kind (such as: free accommodation, housing rent relief, as well as free or discounted benefits and other facilities), pension income, employee incentive, severance pay and so on. Self-employed persons may voluntarily participate in the national pension plan, with a minimum contribution limit when the insured.

Indonesia: Indonesia's social insurance known as the National Social Security System (National Social Security System), ( Badan Penyelenggara Jaminan Sosial, BPJS) under the Ministry of Health BPJS (BPJS for Health) and the Ministry of Manpower by the social insurance management organization BPJS ( BPJS for Manpower) respectively manage the implementation of various social insurance programs. According to the employer to pay monthly wages and salaries of employees paid employee accident compensation (Workers 'Accident Compensation), aging workforce compensation (Workers' Old Age Compensation), employee compensation for death (Workers 'Death Compensation), employee pension compensation (Workers' Pension Compensation ) compensation and employee health (workers 'health compensation), employees paid monthly wages and salaries of employees aging compensation, employee compensation and pension compensation for employees' health. Monthly wages and salaries of all employees, including wages and salaries obtained in cash, compensation and benefits, below market rate loans, directors fees income. Self-employed persons may voluntarily insured BPJS, Medicare payment amount based on each category corresponding to a fixed payment of the remaining social insurance program is voluntary insurance.

Singapore: Singapore's social insurance has only CPF (Central Provident Fund), shared by employers and employees. CPF base of social insurance premiums for employees total daily wages calendar month, including those employed worked all month about the total compensation, such as basic wages and salaries, overtime pay, employee benefits, annual bonus, vacation pay and other incentive payments Wait. Self-employed are required to pay according to their annual net operating revenues to the central provident fund medical savings, net operating income Total operating income minus deductible expenses, capital reduction, the balance of operating losses and other items, but it does not include dividends and interest on savings and income.

Hong Kong, China: Hong Kong region of China's social insurance has only MPF (Mandatory Provident Fund), shared by employers and employees. Mandatory Provident Fund of social insurance premiums for their employees monthly income base, including base salary, vacation pay, commissions, bonuses, subsidies and allowances. Self-employed need to press the previous fiscal year of assessable profits (ie taxable profits, referring to Hong Kong arising in or derived from Hong Kong all the profits, minus all expenses due to the current taxable profits generated, but does not include the sale of shares the mandatory Provident fund and payment of current assets of the acquired profits.) calculated.

China Taiwan: Taiwan, China social insurance includes old-age insurance for All (National Pension Insurance), the National Health Insurance (National Health Insurance), labor insurance (Labour Insurance), pensions (Pension Fund) and employee benefits (Employee Welfare Funds), by the employees, employers and the government shared. According to the employer to pay to pay national health insurance, labor insurance, pension and employee benefits, employee wages and salaries paid monthly national health insurance and labor insurance (except work injury insurance part) to monthly wages and salaries of employees. Above monthly wages and salaries paid by the employer to employees include wages and salaries, grants, subsidized, cash awards, bonuses, and other laws and are not allowed to tax-free income. Social insurance contributions on various projects concerned, under normal circumstances (different insurance will be based on the insured's situation, such as the level of income, family situation and other applicable different proportion of subsidies), the National Health Insurance program borne 60% by the employer, employees to take 30%, 10% government subsidy; labor insurance by the employer to bear 70% of employees to take 20%, 10% government subsidy. Self-employed income needs based on their monthly income to pay national pension insurance, universal health insurance and labor insurance, which the government offers 40% subsidy for labor insurance

Summary comparative base range of social insurance (b) 11 countries (regions)

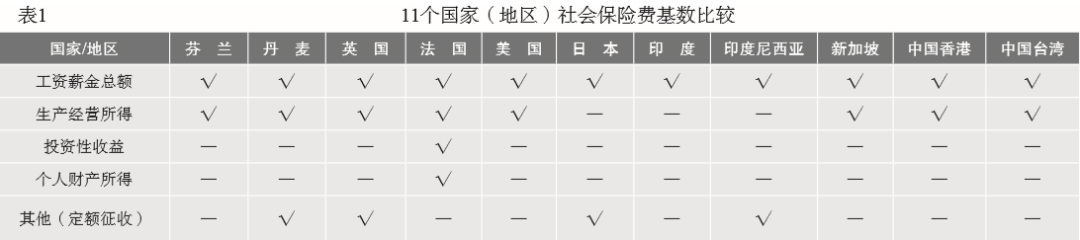

根据上文列举,11个国家(地区)的社会保险费主要征收来源为员工的工资薪金总额及个体经营者的生产经营所得,其中大部分国家明确将工资性质的非现金收入都纳入了工资薪金总额的范围中。这些所得的性质均为劳动性所得。截至2019年3月15日,法国是所选11个国家(地区)中唯一将财产投资收入、财产出售资本利得纳入社会保险费基数的国家(地区)。汇总情况见表1。

二、现阶段我国社会保险费费基存在的问题

(一)费基范围过窄,不同身份人群的费基口径不一,间接导致费率过高

笔者认为,我国目前社会保险费费基主要是工资薪金,未将股权激励、免费住房、实物福利等其他收入纳入基数范围,可能间接导致费率过高。社会保险费缴费主要取决于两个因素,一是费基,二是费率。在当前费基过窄的背景下,为确保社会保险费收支平衡,政府只能选择较高的费率,而过高的费率将会影响小微企业发展,也与国民收入来源日趋多样化的现实不符。

此外,城镇职工与灵活就业人员(包括个体工商户)在缴费基数上的口径要求不一样,其中:城镇职工的缴费基数只能按其上一年度自身平均工资作为本年度缴费基数,没有费基的可选择性;但灵活就业人员并未根据其实际的生产经营净所得作为缴费基数,而是可以在当地社会平均工资的上下限之间自行选择缴费基数。

(二)工资总额的执行口径不一,征管难度较高

我国城镇职工社会保险费的缴费基数为员工的工资总额。关于工资总额有三种不同核算口径。第一种是从企业会计核算的视角,将企业“应付职工薪酬”会计科目核算的成本费用认定为工资总额;第二种是从个人所得税视角,将“个人所得税--工资薪金所得”缴纳个税的收入认定为工资所得;第三种是按《中华人民共和国劳动和社会保障部社会保险事业管理中心关于规范社会保险缴费基数有关问题的通知》(劳社险中心函〔2006〕60号)及1990年国家统计局发布的《关于工资总额组成的规定》(国家统计局令第1号),将凡是工资性质的收入均作为工资总额。理论上,应根据统计局的工资性质收入口径计算缴费基数,但实务中,企业出于各种原因,存在社会保险费基数选择不规范的现象,导致监管成本与征管难度加大。不同口径的工资总额见表2。

(三)费基上下限的基数不够合理,低收入者负担重

我国城镇企业职工基本养老保险缴费基数设置了上下限,分别为上年度在岗职工平均工资的300%、60%。在岗职工平均工资=报告期内实际支付的全部非私营企业职工工资总额÷报告期非私营企业全部职工平均人数。但是,一方面,我国的收入分布不平衡,在岗职工平均工资不能反映大多数在岗职工的工资水平;另一方面,在岗职工统计范围是规模以上城镇非私营单位就业人员,但众多私营单位就业人员、个体工商户和灵活就业人员未被纳入指标统计范围。此外,纳入指标统计范围的就业人员工资相对较高,而未被纳入指标统计范围的就业人员工资相对较低,粗略估计,全口径下在岗职工平均工资指标值预计降低20%~30%。因此,笔者认为费基上下限指标不够合理,低收入者合规缴纳社会保险费的负担较重。

三、我国社会保险费费费基的改革建议

(一)从法律层面统一社会保险费各险种的缴费基数

《中华人民共和国社会保险法》第十二条规定:用人单位应当按照国家规定的本单位职工工资总额的比例缴纳基本养老保险费,记入基本养老保险统筹基金。职工应当按照国家规定的本人工资的比例缴纳基本养老保险费,记入个人账户。截至目前,全国范围内,各省份对社会保险费缴费的单位部分的基数是否与职工基数之和一致,是否需采用不同的基数等问题,尚无定论。实务中,同一省市各企业的计算方法也存在不一致。此外,目前尚未在法律层面明确基本医疗保险、失业保险、生育保险的缴费基数。因此,建议从法律层面统一社会保险费各险种的缴费基数,同时明确单位缴费基数与职工个人的缴费基数之和是否一致。

(二)出台法规细则,规范并做实社会保险费基数

针对目前社会保险费缴纳实务中,缴费人普遍感到困惑的问题,建议国家出台相关法规细则,对社会保险费基数的范围予以准确清晰的界定。同时,为提升社会保险费征管效率,建议社会保险费基数口径与个人所得税的工资薪金所得口径统一。

(三)完善并细化社会平均工资统计方法

为避免社会平均工资“虚高”和缴费基数下限“虚高”,建议完善、细化社会平均工资统计方法,将城镇非私营单位员工、中小企业等私营单位员工、个体劳动者的经营收入等,均纳入社会平均工资的统计范畴,真实核算社会保险费缴纳人员的缴费基数上下限。

(四)扩大社会保险费统筹人员的范围

社会保险统筹范围应遵循“大数法则”,低水平、广覆盖、多层次,参加保险的人数越多(覆盖面越大),互济功能越大,抗御风险的能力越强。建议建立覆盖城乡的社会保障体系,统筹考虑城乡社会保障制度,逐步将各类人群纳入覆盖范围,实现城乡统筹和应保尽保。在城镇,继续完善养老、医疗、失业、工伤、生育保险制度,逐步把各类职工和灵活就业人员全部纳入覆盖范围;研究制定城镇未参加养老保险的困难集体企业和无工作老年人的基本生活保障办法。在农村,全面建立农村最低生活保障制度,进一步推进新型农村合作医疗,探索农村社会养老保险制度,建立与家庭保障、土地保障相结合的保障体系。

(五)完善社会保险费稽核制度

在实践中,许多地区社会保险费稽核往往侧重于对基本养老保险欠费的稽核,没有将企业申报的缴费人数和缴费基数纳入稽核范围。由于社会保险经办机构强制执行力度有限,在被稽核对象拒绝稽核或伪造、毁灭有关账册、资料,迟延缴纳社会保险费的现象发生时,社会保险经办机构只能报请社会保障行政部门依法处罚,而社会保障行政部门也需要诉诸人民法院行使强制执行权。这种做法不仅损害了社会保障行政部门作为行政执法部门的权威性,致使行政稽核、行政监督、行政处罚的作用无法有效发挥,而且由于程序繁冗、时间拖延,对社会保险费的征缴造成不利影响。因此,建立具有强制力、执行力的专门的社会保险稽核机构以及社会保险缴费基数公示制度,对于保证企业足额缴纳社会保险费,具有重要的组织保障和社会监督作用。