SaaS industry forecast 2018 revenue structure and future development [map]

http://www.chyxx.com/industry/201908/774792.html

SaaS (Software as a Service, Software as a Service) refers to the application of a uniform manufacturers will deploy on its servers, according to the actual needs of customers to order and pay vendors, and ultimately services via the Internet model. As the uppermost layer, directly to the user's application stratus service, SaaS is often built on PaaS and IaaS on the basis of the underlying, that provide the appropriate infrastructure is supported by SaaS vendors. Compared to traditional software, SaaS biggest feature is its multi-tenant architecture, multi-tenant resource reuse can effectively reduce the development and operation and maintenance costs and achieve sustained and rapid upgrades iteration. Focus on the enterprise market, it does not involve SaaS products for individual consumers.

American Salesforce CRM SaaS companies have long been a benchmark for global SaaS industry. 2018, Salesforce market capitalization exceeded 100 billion mark for the first time, from a market capitalization of $ 50 billion to $ 100 billion, it took less than three years. Have to build "Chinese version of Salesforce" ambitious Chinese SaaS vendors few, but so far no one can hold a candle has not yet appeared. In fact, not only in the SaaS industry, even magnify the whole enterprise services market, the market value of Chinese manufacturers far behind the US and European markets, has great room for growth and consumer services compared.

Assess the company's value depends on the profitability of assets, SaaS vendors to customers at the core subscription business model, the customer's willingness to pay and ability to directly determine its market value. Compared Salesforce subscription revenue accounted for more than 90%, gross profit margin of nearly 80% over the past few years, China SaaS vendors widespread pain point is that SMEs prefer free products, willingness to pay to be activated, medium and large enterprises are accustomed to customized project service model, SaaS initiative for standardization of products is limited.

2019 Chinese and European consumer and enterprise services market comparison

|

-

|

China City (about 14 million people)

|

European markets (about 12 million people)

|

|

Consumer

|

+ + Baidu, Tencent, Alibaba

market value of about $ 1 trillion |

Google + Amazon + Facebook

worth about $ 2 trillion |

|

Enterprise

|

There is no market value of more than

$ 20 billion company |

Oracle + SAP + Salesforce

market value of about $ 450 billion |

Source: Public data compilation

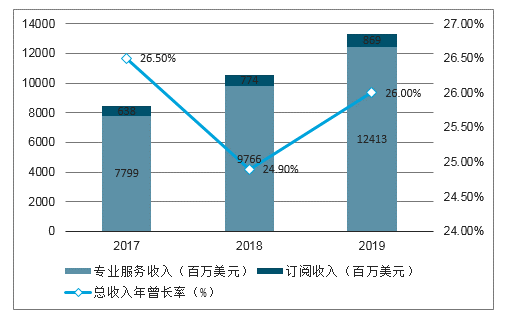

Salesforce 2017-2019 fiscal year revenue growth and structure

Source: Public data compilation

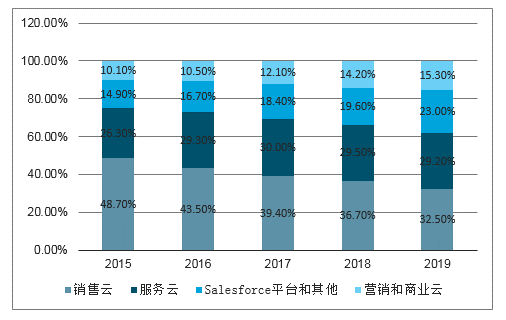

Since its launch in 2007 Salesforce PaaS platform, its AppExchange application market platform brings together over 4000 models pre-integrated applications, PaaS platform associated with the growth of cloud services revenue accounted for the proportion of revenues to 23.0% in fiscal year 2019. Salesforce success by building an open platform PaaS initiatives to expand and improve their function, so for many domestic SaaS vendors to follow suit. 2014, leading players in the field of CRM, OA synergies and other vertical products based on their beginning to build cross-border mobile office platform. Backed by Ali and Tencent micro-letters of nails and businesses to enterprise-level IM strong cut, large-scale expansion in a short time, competition for space narrowing quickly lead to a lot of cross-border players Arrested Development. From the current market performance, is not yet a similar amount of body Salesforce PaaS platform to platform neutrality, data between platforms and developers and vendors to get through the distribution of benefits and many other issues remain to be resolved.

2015-2019 Salesforce subscription revenue that is cloud services revenue structure

Source: Public data compilation

2018年,中国GDP占全球的比例达到15.8%,但中国企业的IT支出占比仅为3.7%,在过去以粗放式增长为主导的模式下,中国经济总量的快速增长在很大程度上没有反应到企业的信息化投入当中。企业信息化整体水平的滞后造成了SaaS市场的预期偏差,在将美国SaaS市场作为对标对象的同时,应当意识到中国企业IT应用的成熟度与个人消费者之间的差异Salesforce在美国市场打出了“软件终结者”的口号,而在中国,SaaS厂商面临的市场环境中依然有大量企业的信息化停留在纸质资料电子化的浅层水平,ERP、SCM、CRM等软件应用并不非常广泛,即在业务数字化尚未完全普及的情况下就需要直接进入到数字化转型阶段。

2015-2018年中国GDP与企业IT支出占全球比重

数据来源:公开资料整理

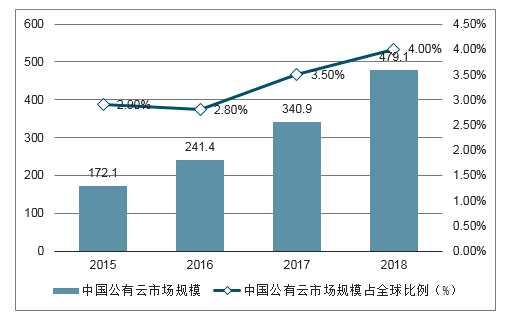

2018年中国公有云市场规模达到479.1亿元,占全球市场的比例由2015年的2.9%上升到4.0% ,超过中国IT支出占全球的3.7%。相比于传统IT产业,云计算产业表现出后来居上的势头。在技术和产业的双重驱动下,企业对云计算的接受程度进一步增加,根据中国信通院数据,2017年中国企业云计算的使用率达到54.7%,上云已经成为当下企业信息化发展的大趋势。考虑到云计算是企业信息化进入到新阶段的技术基础和关键推动力,中国云计算产业的欣欣向荣将有望拉动企业信息化整体水平的提高。

2015-2018年中国公有云市场规模及占全球比例

数据来源:公开资料整理

2018年,中国企业级SaaS融资笔数由上年的368笔下降至287笔,资本市场热度有所降低。其中,业务垂直型SaaS的下降更为明显,主要原因是以CRM为代表的明星赛道已经出现数家头部厂商,留给新进入者的市场空间收窄。相较而言,行业垂直型SaaS起步稍晚且市场更加碎片化,正处在资本的高关注度阶段。融资轮次方面,2018年SaaS行业中A轮及以前的融资笔数占比由上年的64.1%下降至52.6%,融资轮次的后移意味着市场逐渐趋向成熟。

2017-2018年中国企业级SaaS融资事件数量

数据来源:公开资料整理

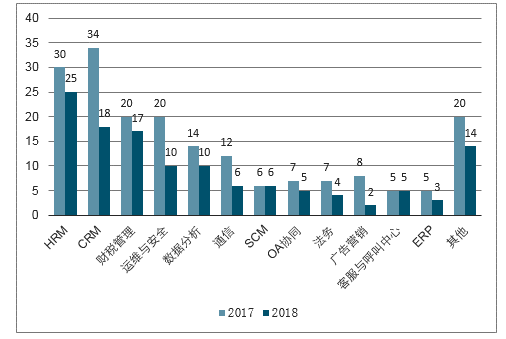

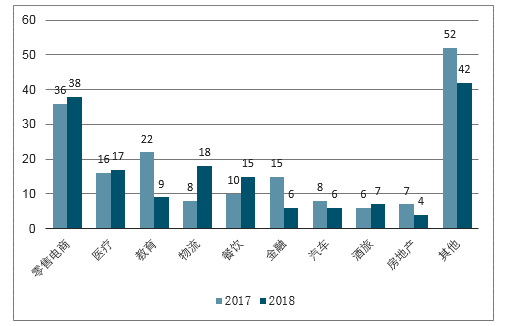

在业务垂直型领域,HRM和CRM赛道最受资本市场的青睐,财税管理、运维与安全、数据分析等领域紧随其后。行业垂直型SaaS中零售电商领域关注度最高,微盟、有赞等领先厂商已经成功登陆二级市场,其他细分赛道投融资笔数差异不大,过去两年内,医疗、教育、物流、餐饮、金融等行业均有超过20笔融资

2017-2018年中国业务垂直型SaaS融资情况

数据来源:公开资料整理

2017-2018年中国行业垂直型SaaS融资情况

数据来源:公开资料整理

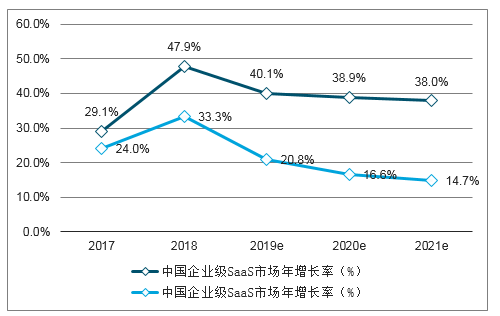

中国企业信息化阶段滞后于美国等领先国家。整体起步较晚的SaaS市场,将在全球市场增长趋缓后继续保持高增长率。预计中国SaaS市场规模占全球的比例将由2017年的4.1%增加至2021年的8.4%,从整体经济体量上看,该比例正快速逼近中国GDP占全球的比例。SaaS有望作为企业信息化的一个突破口,加速拉近中国与领先国家之间的差距。

2017-2021年中国和全球企业级SaaS年增长率

数据来源:公开资料整理

2017-2021年中国企业级SaaS市场规模和GDP占全球比例

数据来源:公开资料整理

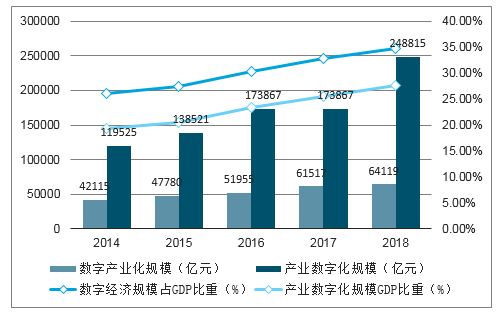

2018年中国数字经济总量超过3.1万亿元,占GDP比重达到34.8%,数字经济内部结构持续优化,产业数字化规模接近2.5万亿元。尽管数字经济的作用正在加速由IT、互联网等信息通信产业向其他产业传导,但能够看到的是,中美产业数字化规模占GDP的比重依然有近一倍的差距,难以在一朝一夕就追赶上。在中国SaaS市场巨大的潜在空间之下,企业信息化整体水平的提高、对软件的付费意愿和SaaS订阅模式习惯的培养都需要时间,2B市场不会出现像2C市场一样的爆发式增长,长路漫漫,仍需砥砺前行。

2014-2018年中国数字经济结构及占GDP比重

数据来源:公开资料整理

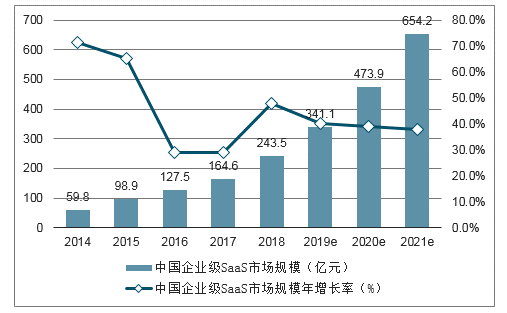

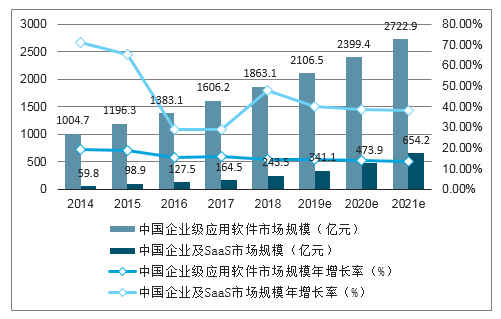

2018 China Enterprise SaaS market size of 24.35 billion yuan, an increase of 47.9% over the previous year. After a brief period of explosive growth, body mass SaaS market quickly jumped, followed by the annual growth rate dropped significantly between 2016 to 2017. Into 2018, the capital market is more rational attitude towards SaaS, customer acceptance of SaaS to further enhance, and each track segment leader in the increasingly mature exploration of commercial, SaaS market growth to rise again. Enterprise-class SaaS market in China is expected within the next three years will remain 39.0% compound annual growth rate, by 2021 the overall market will reach 65.42 billion yuan.

2014--2021 China's enterprise SaaS market size and forecast

Source: Public data compilation

Compared to traditional software, SaaS simplified management, fast iterative, flexible pay and continuous service advantages become more prominent in the current competitive environment, it would become more and more business customers under the preferred scenario. 2018 China accounted for SaaS application software market size increased from 6.0% in 2014 to 13.3%, software SaaS trend is irreversible, is expected by 2021 this proportion will further increase to 24.0%. Taking into account the gap between Chinese enterprise information with the leading countries in the proportion of business revenues for IT spending rise every ten thousandth to release more than 20 billion yuan of market space, while corporate IT spending structure has also been optimized, the proportion of investment in application software will continue to rise. Can one say, SaaS market potential far beyond the current size of the application software, the future market space will be considerable.

2014--2021 China's enterprise applications software and SaaS market size and forecast

Source: Public data compilation

Related Report: Chilean research Consulting released " 2019--2025 China's SaaS industry market operation situation and strategy consulting research report "